The USD rebound extended to the 1.3030 area yesterday, about where we think the short-term USD consolidation should run out of steam.

Soft trade data for November sustain the weak Q4 GDP outlook—Scotiabank Economics’ GDP Nowcast is tracking growth of virtually zero for the quarter currently, versus the BoC’s forecast of 1.3% in the last MPR. This is an important benchmark for policy makers and it remains to be seen whether BoC Gov Poloz remains as sanguine on the outlook in tomorrow’s comments from Vancouver as he was in Dec.

For now, we think CAD-supportive spreads and relatively firm crude prices can keep the USD advance in check certainly in the medium run. A dovish tilt to the governor’s comments tomorrow is a risk for the CAD, however.

Despite our expectations that Canada loses its cyclical exceptionalism and CAD unwinds some of its outperformance, the resulting currency weakness will be only modest, rather than large and broad.

Trading and Hedging Strategy:

Considering above underlying factors, we advocate 1% in the money put options of 2m tenors that seems to be the best suitable on hedging as well as trading grounds.

The rationale: USDCAD closed out 2019 on the defensive and made a crucial weekly/monthly close below long-term support zone of (1.2950 – 1.3165) drawn off the 2015-17 support zone for the USD on the longer run charts.

Although the pair has been attempting show some minor rallies from last 2-3 days, it is unwise to buck the major trend, interim rallies in the minor trend may be deceptive, and hence, we’ve considered ITM put options capitalizing on some driving forces. Below are the key factors listed out that drives us to prefer these derivatives instruments:

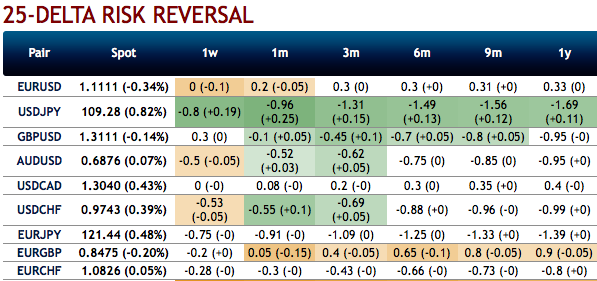

1) The bullish neutral risk reversal numbers indicate the inertia in hedging sentiments, while the underlying spot has been bearish (refer 1st chart).

2) While the positively skewed IVs of 3m tenors are indicating both the downside as well as upside risks (refer 2nd chart).

3) Please be noted that the payoff structure is quite handsome as it dips below 1.30 (BEP) (refer 3rd chart), hence, it is suitable for trading purpose also.

4) These ITM puts (2m) are fairly priced-in as they trading at CAD 1799, whereas Net Present Value (NPV) of these options are just 1713 which means they are trading at just shy above 5% and the IVs of 2m tenors are oscillating between 4.5 – 4.75% (refer 4th chart). Courtesy: Ore, Sentry, & Saxobank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different