Ahead of Swiss National Bank’s monetary policy that is scheduled for this week, we expect the SNB to maintain its expansionary monetary policy stance (libor rate to remain on hold at -0.75%).

We have upgraded the risk bias around the forecasts from CHF negative to neutral. The pair (USDCHF) has been oscillating between 1.0354 – 0.8715 levels from the last couple of months. This long-lasting tight range-bounded major trend likely to prolong further.

OTC Updates and Options Strategy:

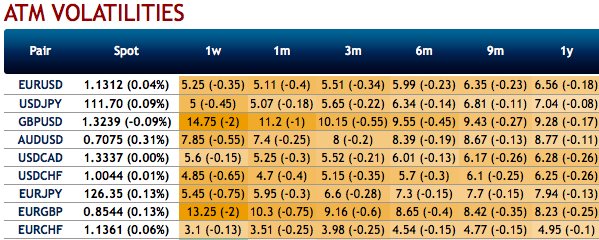

Amid the tepid underlying spot FX movements, let’s just quickly glance through implied volatility (IV) nutshell before deep diving into the strategic frameworks of USDCHF. CHF crosses are showing the least IVs among G10 FX bloc (1m IVs are at 4.7% and 3.51%for USDCHF and EURCHF respectively).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility.

Ascertaining future volatility accurately is almost impossible for any FX veteran. Nevertheless, computing the marketplace’s expected future volatility is quite feasible using the option’s price itself which is known as implied volatility (IV).

3-Way Option Straddle Strategy on Hedging Grounds: Contemplating non-directional trend and all other above rationale, the recommendation would be buying (1m) At the money +0.51 delta call and at the money -0.49 delta put options with similar expiries, simultaneously shorting an OTM call of 2w expiries.

USDCHF Strangle Shorts: As you could observe the swings in the major trend have been oscillating between 1.0354 and 0.8715 levels since June 2015 and most importantly, capitalizing on sluggish IVs it is wise to short (0.5%) out-of-the-money call and (0.5%) out-of-the-money put options of 2w tenor. The strategy can be executed at the net credit and certain yields would be derived in the form of initial premium received as long as the underlying spot FX remains between OTM strikes on the expiration. Courtesy:

Currency Strength Index: FxWirePro's hourly CHF spot index is inching towards 86 levels (which is bullish), hourly USD spot index was at -98 (bearish), while articulating (at 12:48 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts