Japan's core CPI prints worse than forecasted, actual -0.5% versus forecasts at -0.4%.

As per yesterday closing the greenback had appreciated by more than 3.6% against the G10 currencies on a trade weighted basis since the beginning of the month and by 3.3% against the currencies of all US trade partners (based on our extrapolative calculation of the trade-weighted Fed USD indices).

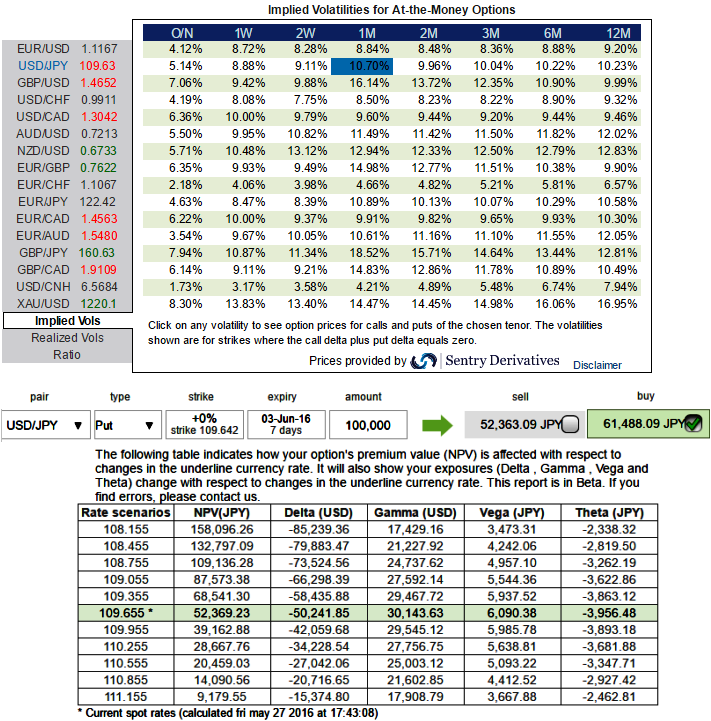

The implied volatility of ATM contracts for near month expiries of this the pair is at around 10.70% and for 1w expiry at 8.88%. , delta risk reversal for the pair is still displays higher negative values among entire G10 currency space for all expiries, so we believe any abrupt short term upswings are the best advantage for bears and may be utilized for shorts in hedging strategies so as to reduce the hedging costs. (Compare delta risk reversal with last week).

The premiums of ATM puts of USDJPY are trading above 17.4% at JPY for lot size 100,000 units. Thereby, we could see the disparity between IVs and option pricing.

Hence, those who compare this difference in options premium with implied volatility, and think the hedging cost for downside risks would not be economical as result of deploying ATM instruments.

Contemplating that factor we cannot afford to remain stuck in this riddle without hedging, so what could be the alternative, in forwards markets at least..?

Subsequently, here comes the "arbitrage strategy" in which options trading that can be performed for a riskless profit as USDJPY ATM put options are overpriced relative to the underlying exchange rate of USDJPY.

To perform this conversion, at USDJPY spot ref 109.639,

the hedger shorts the underlying spot FX and offset it with an equivalent synthetic short put (i.e. short spot FX + long ATM call) position.

Profit is locked in immediately when the conversion is done, the profit would be the difference between the short price of spot FX and price of forward price and premium paid.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data