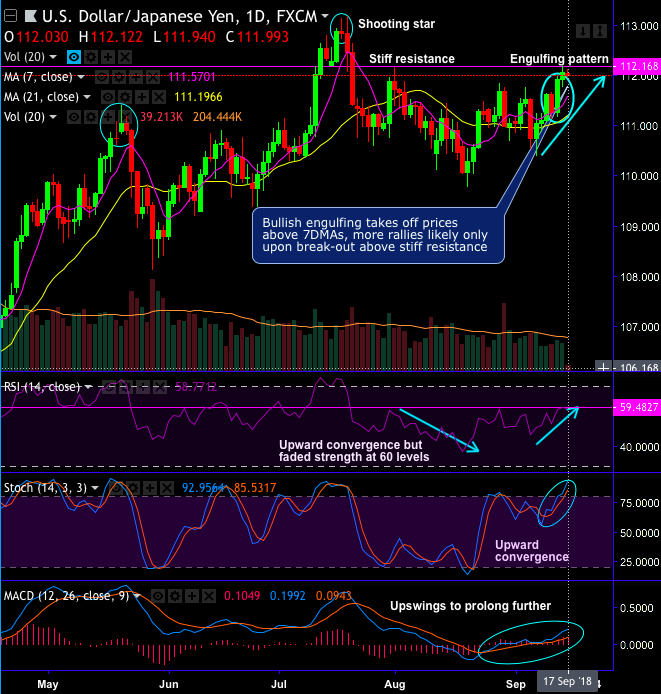

- The bullish engulfing pattern has occurred at 111.922 levels on daily plotting of USDJPY, consequently, the current price spikes above DMAs as the upswings extend further yesterday as well. But for today, stiff resistance is observed at 112.168 levels. More rallies likely only upon break-out above this resistance. Both leading oscillators show upward convergence but the faded strength is seen at 60 levels (see daily RSI curve). Both lagging indicators show bullish DMA & MACD crossovers that signal upswings to drag further.

- As BOJ’s monetary policy is scheduled for this week, FX market likely to nudge trade war tormentor for a while. While there is no sign of raising rates for a quite some time and the recent phases to shift policy more flexible are not targeted at placing the groundwork for an eventual exit from its massive stimulus.

- While the current intermediate trend is wedged between 115.624 and 104.629 levels (refer weekly charts).

- On this timeframe, bulls have retraced from the March 2018 bottom of 104.687 levels to the December 2016 highs (118.833), but currently, prices seem to be slightly edgy at around 50% Fibonacci levels (refer weekly plotting). Price action on this timeframe has been showing overbought momentum into the long-lasting range bounded trend.

- If 50% Fibonacci level and 7-EMA doesn’t act as the major support, then, we could foresee bullish invalidation on retrace below.

Trade tips: On trading perspectives, it is wise to bid one touch call options using strikes at 112.168 levels.

Alternatively, on hedging grounds, at spot reference: 112.003 levels, we advocate shorting futures contracts of mid-month tenorsahead of the Bank of Japan’ monetary policy that is expected to stand pat this week after widening the target band of 10-year bond yield to ±0.2% at the July meeting.

As the underlying spot FX likely to target southwards 109 levels in the medium-runwriters in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 56 (which is bullish), while Hourly JPY Spot Index was at -95 (bearish) at 07:10 GMT.

For more details on FxWirePro's Currency Strength Index, visit below web-link:

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady