Please be noted that the shift in delta risk reversals of this pair still indicates short term bullish hedging sentiments and downside risks in long run remain intact.

Even if the aggressive volatility investors wants to capture JPY should consider buying ATM instruments and/or being long of the smile convexity, against ATM volatility.

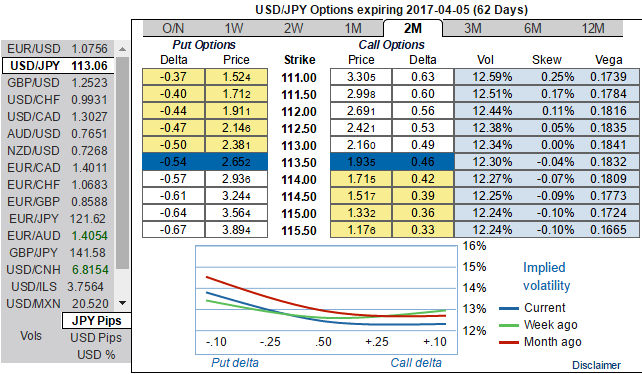

We, therefore, recommend buying a 2m IV skews that signals downside risks and shifted risk reversals, as a result, the below options strategy is advocated contemplating prevailing OTC buzz.

But further USDJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would unlikely to rise significantly as the IVs do not seem to be favoring these distant strikes, hence prefer ATM instruments in below strategy.

Hedging Recommendation:

Initiate longs in 2 lots of 2m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of the similar tenor, The payoff function of the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that as shown in the diagram the trader can still make money even if he was wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

When to use this strategy: Suppose any negative surprising news lingering around USDJPY and you want to take your odds on downside risks – you can trade a strip.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings