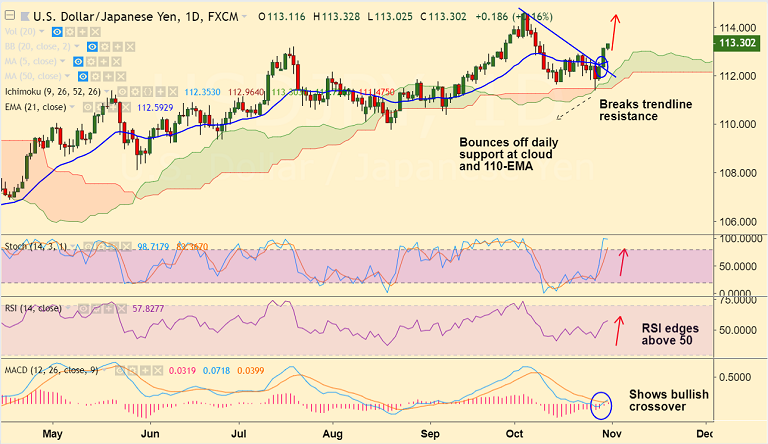

USD/JPY chart on Trading View used for analysis

- BoJ holds policy unchanged, as widely expected. Holds rates at -10bps while maintaining 10yr JGB yield target at 0.00%.

- The central bank also made no changes to a new forward guidance, pledges to keep interest rates extremely low for an extended period.

- The central bank made downward revisions to the Japanese growth and inflation forecasts.

- The pair is consolidating previous sessions gains above 113 handle and is poised to extend its advance up to 113.40 (Sept 8 high).

Support levels - 112.60 (5-DMA), 112.20 (55-EMA), 111.54 (110-EMA)

Resistance levels - 113.40 (Sept 8 high), 114, 114.55 (Oct 4 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-USD-JPY-bounces-off-daily-cloud-positive-momentum-likely-to-continue-good-to-go-long-on-dips-1450650) has hit TP1/2.

Recommendation: Book partial profits at highs. Hold for further upside.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  FxWirePro: AUD/USD remains buoyant, looks to extend gains

FxWirePro: AUD/USD remains buoyant, looks to extend gains  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro: NZD/USD slips as New Zealand’s unemployment rises in Q4

FxWirePro: NZD/USD slips as New Zealand’s unemployment rises in Q4  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout

EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data