The U.S. dollar tumbled over 1% to a one-month low against the other major currencies on Wednesday, as Donald Trump appeared to be winning the U.S. presidential election.

Markets began pricing in owing to a Trump’s victory after the Republican candidate took the lead in the bellwether states of North Carolina, Ohio and Florida.

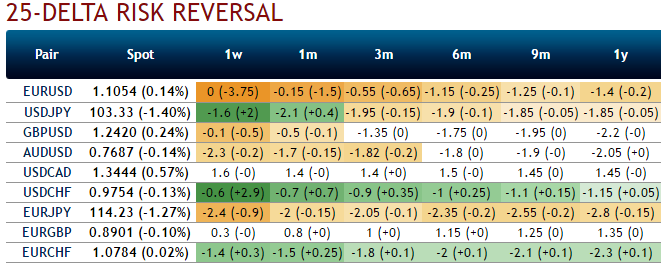

USDJPY risk-reversals:In a nutshell, short term bullish risks and long-term bearish risks.

Well, risk-reversals of this pair are still very much a work in progress as far as vol selling opportunities go, with current levels (3M 25D risk reversals at 1.8 vols for USD puts over USD calls) still removed from post-Brexit extremes (2.8), 1m IV skews to substantiate this signal offered by risk reversals.

If we do get close to those levels however, selling yen riskies should be highly attractive since the BoJ's yield curve control policy is proving more successful in capping JGB yields and suppressing yen vol than we had initially imagined, and a widening US-Japan yield gap as the Fed cycle resumes could conceivably even push USDJPY gradually higher towards the 105-107 area.

Needless to say, selling expensive yen calls should prove profitable amid such a mild updraft in USDJPY spot.

In spot FX, USDJPY plummeted more than 2.75% to 101.190 but recovered to trade the current 104.292 levels in the late European sessions. Japan reiterated its readiness to intervene in currency markets on Wednesday morning. The country's Finance Minister Taro Aso said on Tuesday that Tokyo will need to respond to moves in the currency markets if the U.S. election results cause a sudden spike in the yen.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation