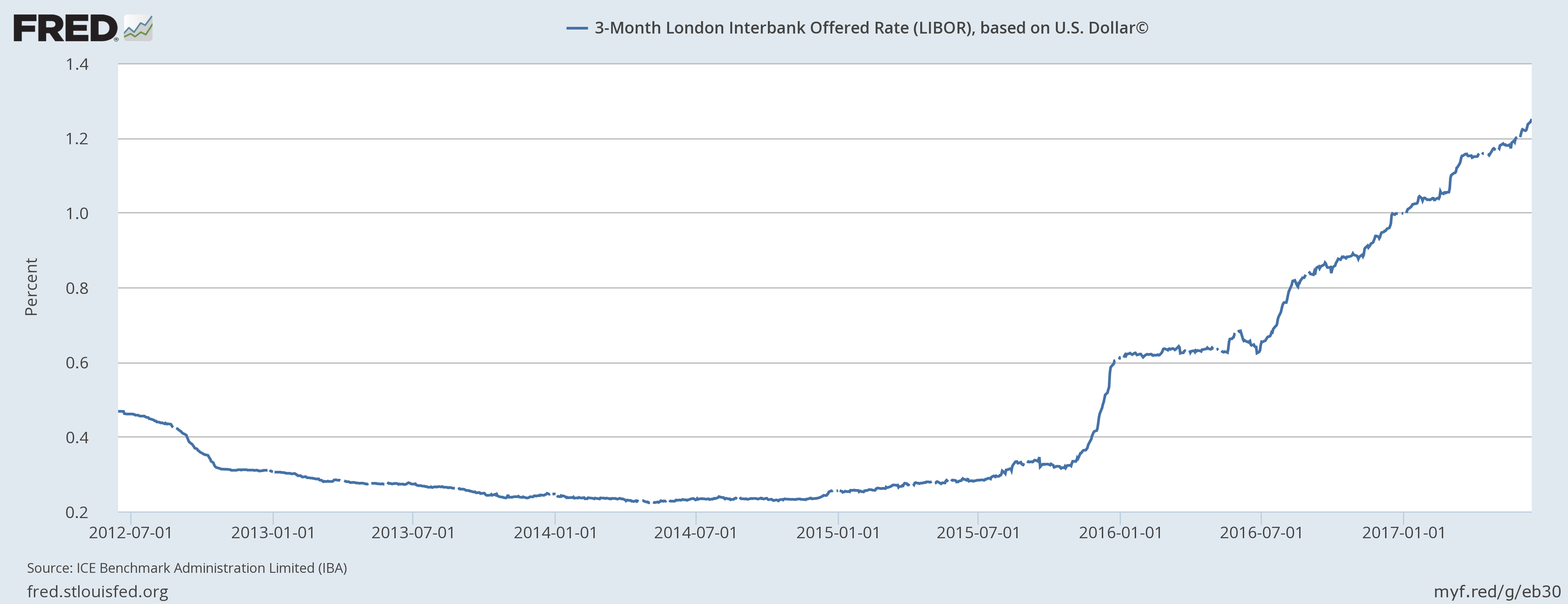

The London Interbank Offered Rate (LIBOR) based on the U.S. dollar that basically reflects U.S. dollar funding cost in the interbank market has reached the highest level since 2009. 3-month USD LIBOR is currently trading at 1.287 percent, which is higher by almost 30 basis points since the beginning of the year. It rose by 10 basis points in the first quarter of the year. After a long decline since the 2008/09 Great Recession thanks to easy monetary policy, the USD Libor has started reversing course by the end of 2014 and has increased by more than 100 basis points.

However, the funding risks in the market remain low as measured by the TED spread. TED spread is the difference between the 3-month USD LIBOR and equivalent treasury, which can be seen as additional cost due to unsecured funding. After increasing to the highest level in September last year around 67 basis points, the spread has eased more than 40 basis points and is currently trading at just 26 basis points. It is also at the lowest level since December 2015, a time when the U.S. Federal Reserve hiked rates for the first time.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength