The USD pairs remain volatile with 10-year US rates on the move. However, following a week of jittery FX spot, the universe of cheap defensive plays is rapidly shrinking.

The Fed is much further advanced in its rate hike cycle and its normalization stance than almost all other central banks. The US is enjoying full employment and inflation has reached its target, as tomorrow’s April data is likely to confirm. As a result, the Fed would probably be the only central bank to take rapid action against higher inflation rates by hiking key rates swiftly – a strong argument in favor of the US dollar. However, this scenario is not entirely certain.

First of all, i) the oil price really would have to rise rapidly, ii) and inflation rates would then also have to rise significantly.

While we are keeping an eye on that front end USD risk reversals have almost fully retraced back to near the January high. At around 7.5 vol handle (up about 0.4vols since last week, VXY-GL basis) front vols appear to offer more opportunities for those looking for defensive gamma hedges.

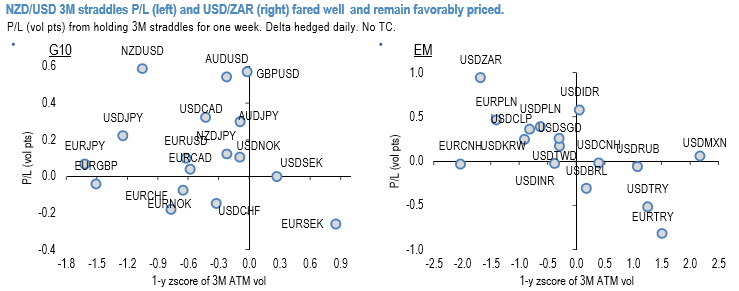

The 1st chart exhibits G10 and EMFX universe of 3M straddles, respectively. Predictably, high beta NZDUSD among G10 and USDZAR among EMFX are two attractive pairs with handsome P/Ls in the recent past. Both endure valued attractively (majorly owing to the favorably low vols prior to the ongoing vol rally).

USDJPY, a generic, catch-all risk off hedge, landed in the promising upper-left quadrant and screens cheap on implied vols (1.2 sigma below 10year average) but its skinny P/L and recently chronical realized vol underperformance makes as wary of yen gamma.

For the time being, we pass on EUR cross vols aiming for a more direct exposure.

Finally, on the back of the heavy foreign bond ownership, USDIDR straddles would have been attractive to own if it was not for the Indonesia central bank which indicated the intention to intervene if IDR continues to sell off.

Historically, short front/long back (e.g. -3M/+12M) USDIDR straddles calendars generated lucrative 5.5 vols annually (after transaction cost), though the structure is net short gamma posing risk from heavy drawdowns.

To short gamma in the current environment, one would need a decently high conviction that Bank Indonesia would indeed keep IDR spot under a watchful eye.

With respect to strikes selection, the outperformance of OTM NZD call strikes relative to NZD puts is systematic (refer 2nd chart) making us favor OTM NZD calls over straddles.

We recommend buying delta hedged 3M 25D NZDUSD calls @8.05/8.375 and delta-hedged 3M USDZAR straddles @13.2/13.6vols, indic. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above 1 level (which is absolutely neutral), while hourly NZD spot index was at -42 (bearish) while articulating (at 11:05 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different