USD-TRY has calmed down ahead of the FOMC decision, declining from near 3.07 earlier in the week to around 3.03, possibly on assumption that the Fed will not liftoff and that this will take pressure off EM FX for now, especially TRY. In the background, however, political developments in Turkey continue to portray a high-risk juncture. One of the more reliable political surveys - polls suggests that the same hung parliament will result.

So thereby our ITM calls on below strategy is working pretty well and now it's the time for OTM calls which has begun its functioning as the pair has dropped from 3.0693 levels to 3.0033 levels.

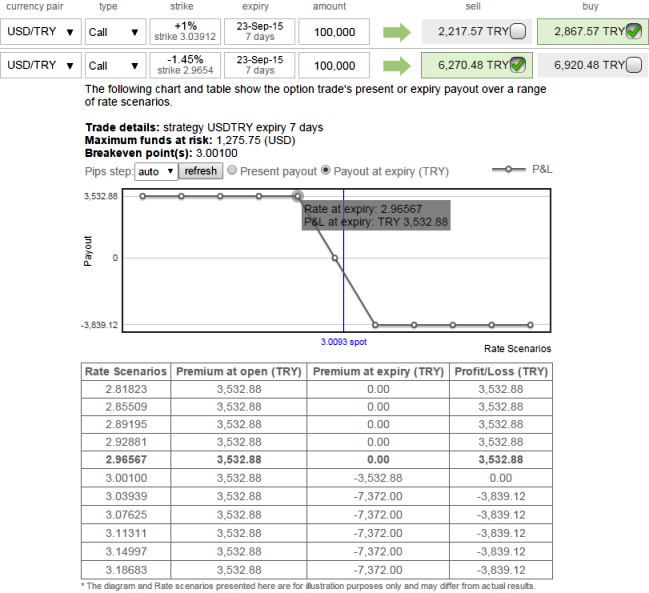

So with swing trading mindset ahead of FOMC event, we recommend buying 1W 1% out of the money 0.41 delta calls and simultaneously short 4D 1.45% in the money call (the pair may drop maximum up to 1.9650), the combined delta value should be around -0.33. We've shown in the diagram as to how the strategy can be built in and a positive cash flow is certain as long as the pair maintains below 2.9656 levels. However, for the demonstration purpose expiries have been identical.

The maximum gain of this call spread strategy is the net initial credit received upon entering the trade. To reach the maximum profit, the USDTRY price needs to close below the strike price of the lower striking call sold at expiration date where both options would expire worthless.

FxWirePro: USD/TRY credit call spreads for swing trading ahead of FOMC decision, Turkish political risks

Wednesday, September 16, 2015 11:39 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings