What a difference a month has made to GBP in terms of immediate central bank prospects, if not the cyclical outlook for the economy or the complex interplay between UK politics and Brexit. The BoE caught the market off-guard at its September MPR when it signaled its intention to commence tightening in ‘coming months’.

The curve had assumed that the BoE would be on hold until early 2019. The result: a dramatic rate re-pricing - a November hike is now 75% priced and two full hikes are discounted by the end of 2018 - and a 5% short-covering scramble in GBP, its second-best monthly performance since 2009.

There is a lack of clarity about what has prompted the shift in the BoE’s reaction function as the MPC has offered partial and sometimes conflicting explanations for its abrupt change of heart (confidence about an acceleration in actual growth versus pessimism about low potential growth, or a simple desire to prop up the exchange rate and lessen imported price pressures?).

It has also reversed its opinion of Brexit and now believes that an inflationary supply shock could dominate a disinflationary demand shock.

Our best judgment is that a more hawkish BoE warrants an adjustment in the level of GBP but doesn’t necessarily improve the medium-term path. The recent 25bp upgrade in 2Y GBP rate differentials adds 3.5% to GBP's cyclical fair-value.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

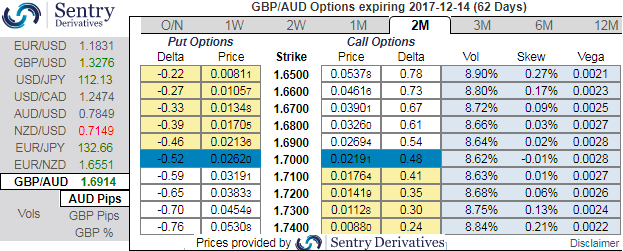

The execution: Initiate long in GBPAUD 2M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 2w (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer. The Vega of a short (sell) option position is negative and an increasing IV is bad.

Rationale: If you glance through the above nutshell showing IV skews that signifies the hedgers’ sentiment is oscillating on either side which is exactly in tandem with the technical trend of this pair (refer above diagrams).

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into -5 (neutral), while hourly AUD spot index was at shy above 137 (bullish) while articulating at 10:49 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand