The EURUSD action, is characterised by relatively range-bound spot markets from last two years with only rupture of realised volatility, is not enough to support an imminent rise in volatility.

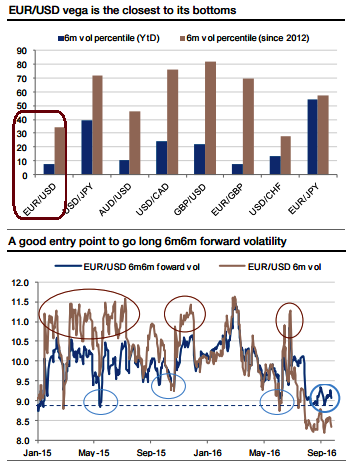

EURUSD is the pair to perceive the least IVs among G7 currency space (6.45% for 1m tenor). An unusually long period of low volatility of volatility is going to be concerning given that volatility is not that low. While vega is also at its lowest level among G10 FX space, we understand that the Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

However, some fundamental factors (central banks in both Euro zone and the US continents) suggest contemplating long volatility hedges, so we investigate how to take advantage of the current low levels selectively.

FX volatility entered a moderate regime in early 2015 but has been under significant pressure since end-July (see above graph). The limited activity of central banks is clearly to be blamed, as per our H1’ FX outlook call, and in the current context, now that the two main events of the week are over (Fed hike and post-Brexit formalities i.e. article 50), volatility markets are experiencing a further sell-off.

Hence, we recommend going long in EURUSD 6m6m forward volatility agreement @9.25.

Risk profile: If vega underperforms, then the investors trading a FVA receive a straddle at the forward date and are exposed in mark to market to the difference between the traded forward volatility and the 6m implied volatility in six months. Afterwards, the loss is limited to the straddle premium, computed as per the initially traded forward volatility.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis