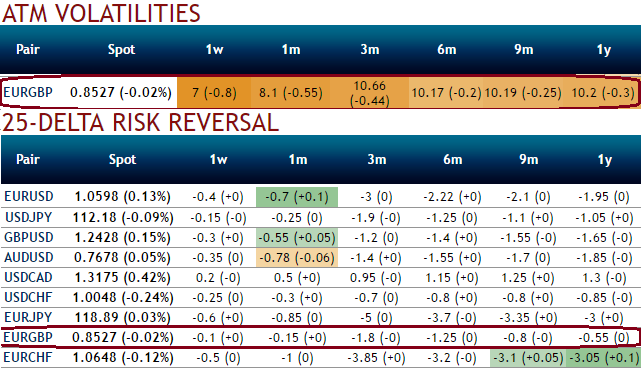

Please be noted that the massive shrink in EURGBP implied volatility of ATM contracts across all tenors.

While the risk reversals, for now, have taken adverse directions from last 1 year’s hedging sentiments that were bidding for upside risks.

Fading towards 8% and below 10.75% for 1-3m tenors, the tepid IVs among G10 FX space despite the fact Eurozone elections are lined up appear to be conducive for call option writers as the delta risk reversals are also bidding for puts progressively with negative numbers that signify hedging arrangements for downside risks over the period of time.

While the positively skewed IVs of ATM contracts are signifying the hedgers’ interests in OTM puts that is in sync with the risk reversal indications.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

On the flip side, when you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

As shown in the above diagram, (2%) OTM calls have been overpriced 11.44% above NPV while IVs of this tenor are just shy above 9.10%.

Hence, considering above OTC market reasoning, we think downside risks are on the cards, as result we reckon deploying shorts in such exorbitant call options while initiating longs in ATM puts in our hedging strategies that seem worthwhile if you have to ponder over the payoff structure under the scenario of the underlying spot FX keeps dipping further.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025