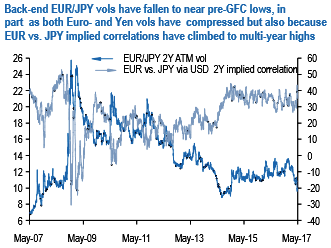

Back-end (>2Y) EURUSD and EURJPY vols look deep value after the de-pricing of European political risk, and materially cheap adjusted for short-end FX and interest rate vols.

A byproduct of the violent de-pricing of French election risk after the first round outcome is that back-end (1Y-2Y) EURUSD and EURJPY vols have crashed to near 2014 lows (refer above chart). This event-related compression comes on the heels of generalized pressure on long-expiry vols across currencies this year due to a mix of Trump-related risk premium squeeze and vol-supplying hedging flows from Japanese importers, European corporates (typically airlines) and the like.

The portfolio has benefited from these dynamics insofar as it is long EURJPY and long TRYZAR, The former was helped by higher core yields and deleveraging of euro-funded positions in high-beta currencies. But the key theme for the portfolio remains European reflation including a core long position in EURJPY.

As such we remain comfortable with long EURJPY exposure as a core trade on European reflation/ receding political risk.

Please be noted that the above nutshells evidencing OTC indications are quite tricky.

Let’s run you through what does it imply, as the delta risk reversals (RR) of euro crosses (especially in EURJPY) have shown a mounting bearish interest as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term. EURJPY is the highly perceived pair to have bearish risks (see for the highest negative numbers among G10 space).

To substantiate this bearish stance, positively skewed IVs of 1m tenors are signifying the hedgers’ interests in OTM put strikes. This implies underlying spot likely plummet further southwards.

Hence, bid EURJPY 3M RR and initiate longs in 2M EURJPY ATM straddles. EURJPY ATM in 60:100:-150 vega ratio.

Please be noted that the above diagram shows that the payoff structure of 1w straddles of EURJPY regardless of swings.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary