As widely anticipated, the Fed hiking cycle continued once more this year as FOMC raised rates by 25 bps (Fed’s Funds rate – 2.50%). At the same juncture, the Fed’s dot plot moved lower over the forecast horizon. These changes are steady with a softer inflation and economic outlook. On the flips side, BoJ has maintained status quo in its last monetary policy of 2018.

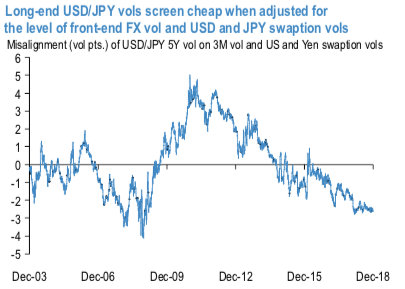

While subdued yen vol levels are moderately cheap, particularly at the long-end, when adjusted for the level of short-dated (3M) FX vol and USD and JPY interest rate volatilities (refer above chart) such that entry levels into strategic vega longs are reasonably attractive. It is true that JPMorgan’s forecast of 118 on USDJPY spot by mid-2019 – 4% above current market – is not conducive to higher yen vol when viewed through the traditionally inverse spot-vol correlation lens. Yet this disregards the change that has taken place in the Greek profiles of yen option books over the past few years due to corporate structures.

Since the advent of Abenomics in late 2012/early 2013 that turned around the post-GFC trend of steady yen strength, Japanese importers have been active buyers of USDJPY via net vol-selling structures such as knock-out (KO) forwards, with KO barriers set in a broad 125 – 140 zones depending on product vintage.

Though locally supplying vol to the street, these structures can swiftly lose vega if USDJPY were to approach 120, as option pricing models start pricing in some likelihood of structures knocking out; the reduced requirement to hold short vega hedges as a result can spur dealer demand for vol even in spot rallies. In other words, yen vol now boasts more of a two-sided, convex relationship with spot instead of the one-sided inverse link of the past, albeit it will require spot to break out of tight recent ranges in either direction to activate this more symmetric spot-vol correlation. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 149 levels (which is bullish), hourly USD spot index was at 37 (mildly bullish) while articulating at (06:44 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated