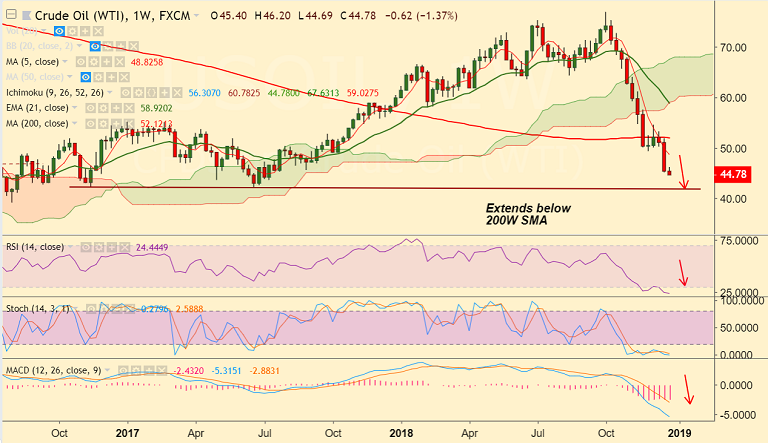

U.S. oil chart on Trading View used for analysis

- U.S. oil price was rejected at session highs at 46.20, slips lower to currently trade at 44.78.

- Sentiment continues to be dented by the looming supply glut worries and economic growth concerns.

- OPEC and allied oil producers are ready to hold an extraordinary meeting and will do what is needed if the current cut in oil output by 1.2 million barrels per day does not balance the market next year, the United Arab Emirates' energy minister said on Sunday.

- Markets skeptical whether the planned supply cuts by the OPEC and other producers such as Russia will be able to stabilize the oil markets.

- Technical studies are biased lower. Price action below cloud and major moving averages. Extends weakness below 200-W SMA.

- We see scope for test of major trendline support at 42 mark. Violation there could see further weakness.

- On the flipside, breakout at 5-DMA could see gains upto 21-EMA at 50.32.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential