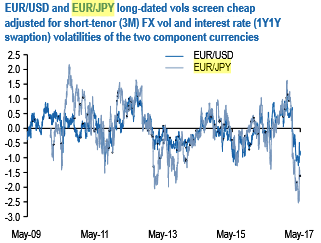

A by-product of the violent de-pricing of French election risk after the first round outcome is that back-end (1Y-2Y) EURUSD and EURJPY vols have crashed to near 2014 lows (refer above chart). This event-related compression comes on the heels of generalized pressure on long-expiry vols across currencies this year due to a mix of Trump-related risk premium squeeze and vol-supplying hedging flows from Japanese importers, European corporates (typically airlines) and the like.

The direction of the vol move appears appropriate given the passage of a potentially disruptive event risk, especially in EURUSD where Euro-rallies have rarely if ever, proven volatile. Yet value becomes the overriding concern once vols fall below certain thresholds, and we believe we are close to those levels seeing how both EURUSD and EURJPY long-dated FX vols are both undershooting meaningfully after adjusting for short-dated FX vol and interest rate (swaption) volatility in the two pairs (refer above chart).

Nominal levels appeal too: EURUSD 2Y vol sub-8, in particular, is in the bottom decile of all available history; EURJPY 2Y vol sub-10 is a relatively more common historical phenomenon but strikes us as the relatively more rewarding hold of the two given (a) the potential for yen to generate volatility in either direction (equity market weakness amid yen strength; structured product effects can create vega demand if the yen weakens materially) and (b) the scope for re-pricing due to not only a surge in Euro and Yen-vol legs individually but also a breakdown of the historically elevated correlation between them (refer above chart) in a classic deleveraging episode.

Triggers for mean-reversion are difficult to anticipate, but appear more likely to be non-European in source assuming polls once again turn out to be correct about the likelihood of a Macron presidency; spillovers from China/commodity market stress and/or US policy volatility (BAT reinstatement, more aggressive than anticipated Fed hikes) are the most likely culprits.

For investors constrained from active delta-hedging of vanilla straddles, volatility swaps and FVAs are viable alternatives, the latter in particular suited as low bleed long vega portfolio hedges along flat vol curves (EURUSD 1Y ATM 7.80, 2Y ATM 7.85; EURJPY 1Y ATM 9.7, 2Y ATM 9.9).

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios