The current price action in the euro remains choppy but essentially range-bound. The trade-weighted index gained 2.5% in the month to mid-September on what seemed like a re-think of the euro’s exposure to Turkey, but then gave back around 1.5% over the past few weeks as Italian stress came to the fore and the dollar was buoyed by the re-think of Fed policy. Over the past 24 hours the euro has turned higher once again as equities have slumped as this has caused a de-risking of the (small) short EUR positions the spec market had established over Italy.

Looking through the month-to-month gyrations we are holding our forecasts steady this month. The end- 2018 projection for EURUSD is modestly lower (1.130) and predicated on a combination of 1) continued divergence in near-term macro-economic momentum between the US and the Euro area and 2) probable further tensions over Italy’s budget if, as seems likely, this is rejected by the EU Commission. The possibility that the BTP spread could overshoot towards 400bp and in turn de-stabilise banks justifies downgrading the risk bias around this forecast from bullish to neutral.

Beyond that, we continue to expect a progressive but nevertheless shallow uptrend in EURUSD through next year to 1.19 to reflect 1) a closure of the growth gap between the US and Euro area from 1.5% so far this year, and 2) a probable improvement in rate spreads in the euro’s favour as the ECB delivers rather more tightening than the curve prices. We continue to believe that delivery of early stage ECB tightening should be more impactful for FX than an extension of late-cycle Fed hikes as the market is liable to become more concerned about the longevity of the US cycle if the Fed is confronted.

After Italian spreads (10 year against Bunds) had climbed to 340bp on Friday morning they collapsed back to 300bp again. Only because EU Commis- sioner Pierre Moscovici seemed to find conciliatory words and explained the EU Commis- sion did not want to influence the economic policies of the Italian government. The euro also recovered in line with the Italian spreads.

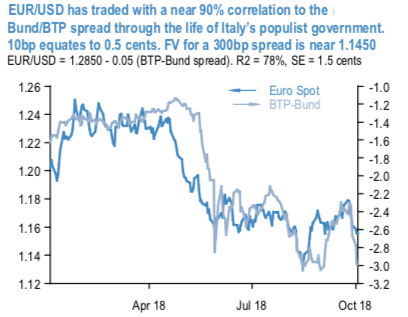

There has been an impressive degree of co-movement between EURUSD and the Italian risk premium ever since the previous Italian parliament was dissolved last December. The correlation through this period is close to 90%, dominated of course by the fraught period following the election in March as investors came to terms with an implausible coalition of populists and the euro sank by nine cents and the Bund/BTP leapt by 175bp (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 36 levels (which is mildly bullish), while USD is flashing at 58 (which is bullish), while articulating at (08:15 GMT). For more details on the index, please refer below weblink:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch