Hawkish commentary from Bank of Canada officials this month has taken the FX market by storm. The implied probability of a 25bp BoC rate hike in its 12 July meeting has exploded from under 5% just three weeks ago to over 70% currently, and a full hike is priced in for 3Q17, according to Bloomberg.

BoC Governor Poloz's latest comments earlier this week were pointedly hawkish, stating that the 2015 rate cuts (of 50bp) “have done their job”, and that the BoC should be reconsidering the policy rate level, as “excess capacity is being used up steadily.” Deputy Governor Patterson also mentioned this week that “the economic drag from lower crude oil prices is largely behind us.”

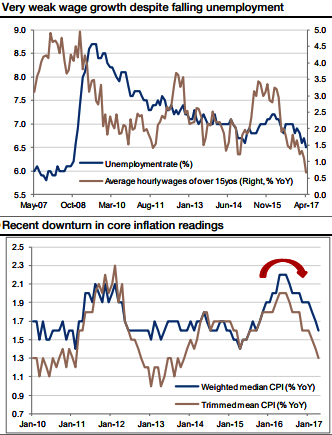

We previously mentioned the positive growth momentum in Canada this year but noted that inflation remained the crucial missing piece. Wage growth has been unexpectedly weak despite the low unemployment rate, and core inflation readings have trended lower for several months (refer above charts).

Nonetheless, the signal from the BoC is very clear, and a rate hike is imminent, if not at the July meeting, then in September. A full economic update will be released with the BoC’s monetary policy report after the 12 July meeting.

Hence, factoring all the above fundamental aspects, Lonnie’s undervaluation should support further appreciation.

USDCAD is attempting to test key support at 1.30/1.2970, and a break will open the way to the May 2016 lows of 1.25. Recent highs of 1.3350 will cap short-term upside. We’ve pointed USDCAD to slide towards 1.25 as the target once support at 1.30 is broken decisively and sustain below this level, as is likely in coming weeks.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data