Although the Bank of Canada sees an overheated housing market and rapidly rising prices as significant financial sector vulnerabilities, Governor Poloz has said that the policy rate is too blunt a tool to try to mitigate household sector imbalances. Macro prudential tools are better suited to cushion the risk and the Bank can best contribute to a soft landing in the housing by ensuring that the economy grows and inflation returns sustainably to the Bank’s target.

Since the Bank of Japan’s (BoJ) last meeting JPY crosses are under pressure, USDJPY has been keeping above the 100 mark. That makes one thing clear: the announcement of a “comprehensive assessment” of its monetary policy on the part of the BoJ fuelled the expectation of further expansionary measures and has thus been able to stop JPY’s appreciation trend recorded since the start of the year.

The central bank of Japan is likely to maintain its pledge of raising the monetary base, the outcome of Wednesday’s BoJ meeting is highly uncertain but those expecting a step-change in policy are set to be disappointed.

The Japanese Yen finished last week lower against the majority of G10 FX as traders react to the BoJ & Fed this week.

CADJPY spot is likely to approach supports at 76.718 levels and as a result CFDs of this pair slightly have been drifting down.

Hedging Framework:

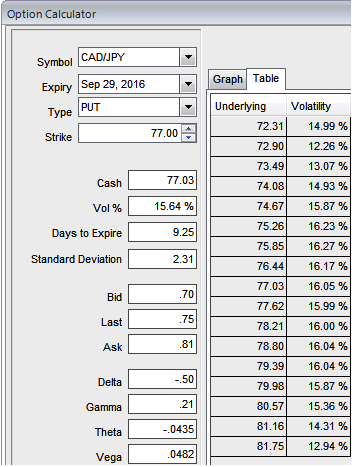

The implied volatility of 1W CADJPY ATM contracts 15.64%.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Since ATM IVs are trading 15.64%, shorting expensive OTM or ATM calls during bearish situations with shorter expiries would likely result in positive cash flow on expiration. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute:

Go long in CADJPY 1M at the money delta put, Go long 1M at the money delta call and simultaneously, short 1M (1%) out of the money call with positive theta.

If one is bearish to very bearish, then one can even eye on writing ATM or ITM calls as well as an alternative to shorting the underlying spot FX.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons