We immediately took the view that the adjustments of the Japanese monetary policy implemented by the Bank of Japan last week amounted to a capitulation on the part of the BoJ. In the meantime, reports have emerged that the BoJ considered rate hikes twice this year. That confirms our fears that the more flexible interpretation of the yield curve target was nothing else but the beginning of the end of ultra-expansionary monetary policy in Japan.

USDJPY had remained in a narrow range (2% from mid-109 to mid-111) until early this week as both USD and JPY moved together.

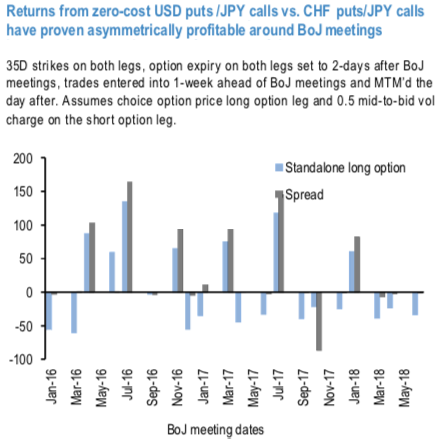

Buying long USD puts/JPY calls around the events provides with a decent performance since 2006 (refer above chart).

However, considering zero cost structures long USD puts/JPY calls vs short CHF puts/JPY calls (assuming 0.5 mid- to-bid charge on the short leg) delivers much more convincing results, with a (on average) positive and highly asymmetric stream of returns.

The long/short strategy underperformed the long only position in only two of the seven market-moving meetings, delivering a negative P&L in just one occasion.

This looks like a good opportunity for positioning for a hawkish BoJ in the months to come.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 84 levels (which is bullish), while JPY is at 111 (bullish) while articulating (at 13:10 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios