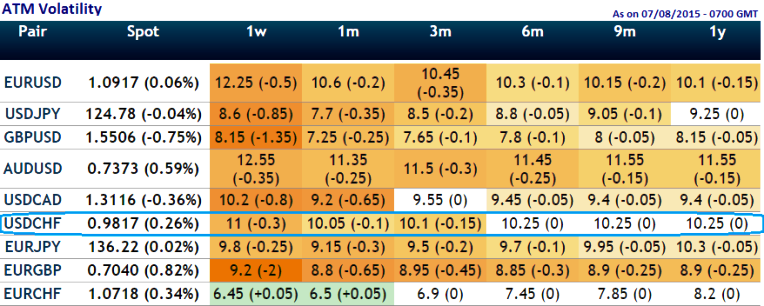

We've been formulating a lot of call spreads on highly volatile currency pairs (USDCHF is the one among the pool, the pair ranks under top three highest among major pairs to perceive volatility of ATM contracts, ATM contracts currently trending at 11% vols) and have been drawing up some customized strategies by using P&L tools and techniques to look at the option Greeks.

While doing so it seems like the OTC option of this pairs have tons of Gamma. It might be puzzling because on one hand it seems some of these options are highly volatile than any other Euro American currency pairs except EUR/USD but a tiny shift in the underlying exchange rate would cause instant disaster. This can be arrested by devoting little time on ascertaining an accurate gamma.

We've constructed call spread by considering gamma closer to zero would neutralize the implied volatility impact on option price and this position remains quite firm to achieve our hedging objectives, because we know gamma represents the change in delta, we have healthier delta at 0.46 at combined position.

This results in desired hedging objective irrespective implied volatility disruptions as we've OTM shorts on side and prevailing bull run will be taken by In-The-Money calls.

FxWirepPro: USD/CHF to perceive HY vols; optimize volatility through gamma spreads

Friday, August 7, 2015 9:46 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings