It is going to be a significant week for pound sterling. Huge flow of series of economic data is pouring in this week. Let's imagine after election whether GBP is able to hold its sustainable gains under the leadership of new government.

CPI data: As the core inflation numbers both YoY & MoM are scheduled to be released today, the gains on pounds are hovering on the back of it. This is pondered as the UK's most vital inflation data because it's used as the BoE's inflation objectives. The inflation rate in the United Kingdom was recorded at 0 percent in March of 2015.

Core Inflation Rate in the UK was increased 1% in March of 2015 over the same period in the previous year.

Output PPI: Both yearly and monthly producers' price index data on producers output are scheduled to be released today. Producer Prices in the UK decreased 1.70% in March of 2015 over the same period in the previous year. Prices received as a result of producers output.

Input PPI: Both yearly and monthly producers' price index data on producers input are scheduled to be released today. Prices paid as a result of producers input. Producer Prices in the UK increased to 107 index points in March of 2015 from 106.80 index points in February of 2015.

RPI data: Retail Price Index YoY and MoM are also scheduled to be released today. This measures the any relative variation in the price of goods and services bought by consumers for the purpose of ultimate consumption.

Derivatives mirror: (GBP/USD)

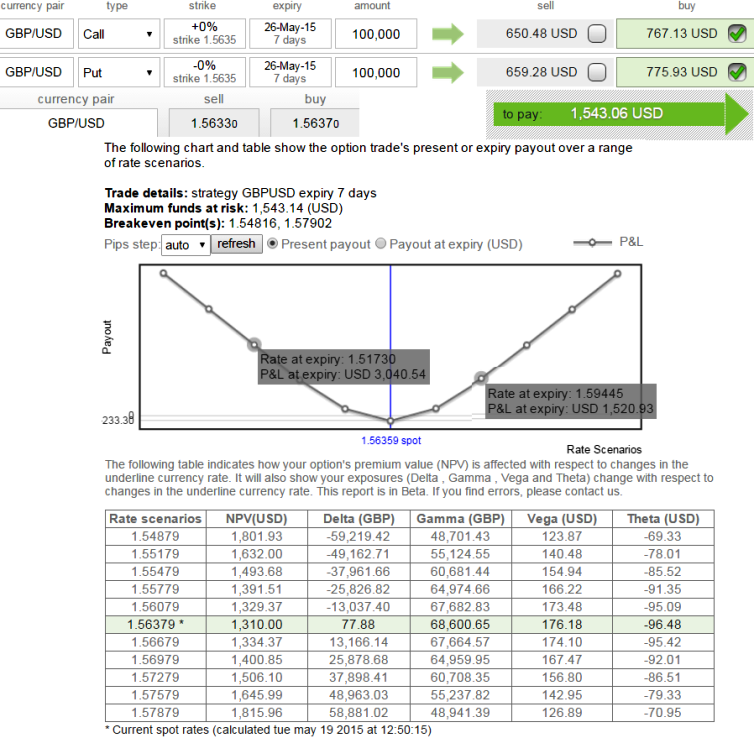

It doesn't seem to hold the strength on US dollar versus GBP on daily charts as we don't see substantial bearish confirmations to fall ahead in upcoming trading sessions. As dollar is struggling to draw its gains we advocate a buy call on straddle of this pair.

Hedge with Option Strategy: Combinations (Buy a Straddle)

Overview: Non directional

With an increased anticipated volatility on series of announcements of significant economic data, the above strategy can help safeguarding the currency portfolios from any uncertain abrupt currency movements.

We are advising to buy both call and put options of same strike prices and same expiry in order to build this strategy.

Best suitable on the verge of economic news or earning seasons etc.

GBP bulls seem reluctant to face downswings

Tuesday, May 19, 2015 7:28 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?