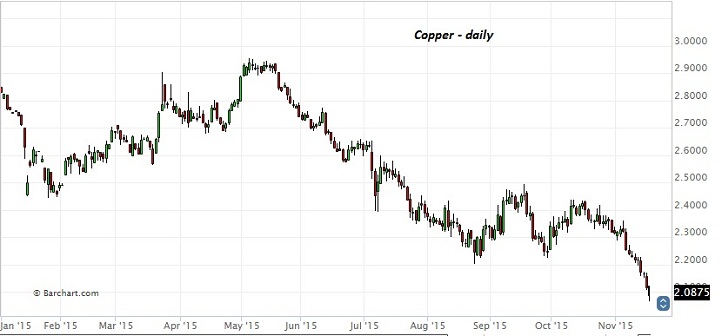

Weakness in economic activity around the globe and especially in China is taking a toll on the red metal, which is now down for 10th consecutive days. Copper, which is often considered as global barometer for growth is definitely pointing to much weaker future.

Copper is currently trading at $2.08/pound, down for 10 consecutive days and in this period it has declined close to 11%. Since May this year, decline has actually gathered pace, as price has declined close to 30%.

Though sentiment around China has somewhat stabilized after massive sell-offs of August, current calm might soon face stormy weather, as fears many. At least one thing can be said with some certainty that China will not be consuming as much metal as before. That leaves a lot of surplus in the market.

Current production cut, as was the case in Glencore, which slashed Zinc and copper production may not be sufficient to pop up prices as demand drop is much faster. Moreover, end of easy monetary policies in US (FED may hike as early as December), lots of financial copper are available for sale in the market.

We at FxWirePro has been calling for price drop in copper for quite a sometime and expect price to dip as low as $1.87/pound and further towards $1.49/pound. However at this point a drop beyond $1.35/pound doesn't seem conceivable.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand