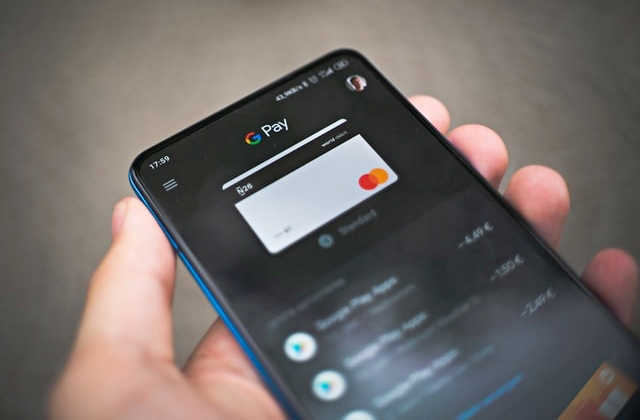

Google will not be adding banking services anymore after scrapping its initial plan to do so. It was reported that the move came almost two years after the tech giant first mentioned its plans to offer banking services to its users.

It was added that the decision to abort the banking plans were aborted several months after an executive leading the project had left the company. It was in early 2019 when Google revealed it will allow users to open their bank accounts using the Google Pay app and this was supposed to be launched last year.

At that time, it was said that the project will be carried out in partnership with Citigroup and Stanford Federal Credit Union. The deal was supposed to begin this year and the project has been named Google Plex checking and savings account.

Google told CNBC that this service has no monthly fees or minimum balance requirement. What’s more, those who will avail of the service can also opt to request for a physical debit card that they can use for transactions. If the project pushed through, this debit card would have operated on Mastercard’s network.

In any case, it was reported that aside from the departure of the key executive handling this project, another reason why Google folded its banking plan is the series of missed deadlines. CNBC stated that the company’s spokesman confirmed the report that they have abandoned the bank account offering.

“Our work with our partners has made it extremely clear that there’s consumer demand for simple, seamless and secure digital payments for online and in-store transactions,” the spokesman told the publication via email. “We’re updating our approach to focus primarily on delivering digital enablement for banks and other financial services providers rather than us serving as the provider of these services.”

Finally, Forbes added that the bank account opening via Google Pay app has been delayed a lot of times. It has also worked on redesigning the app already but in the end, they have made the decision to just call off the project.

Netflix Stock Jumps 14% After Exiting Warner Bros Deal as Paramount Seals $110 Billion Acquisition

Netflix Stock Jumps 14% After Exiting Warner Bros Deal as Paramount Seals $110 Billion Acquisition  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement  Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears

Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move

Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move  Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding

Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology