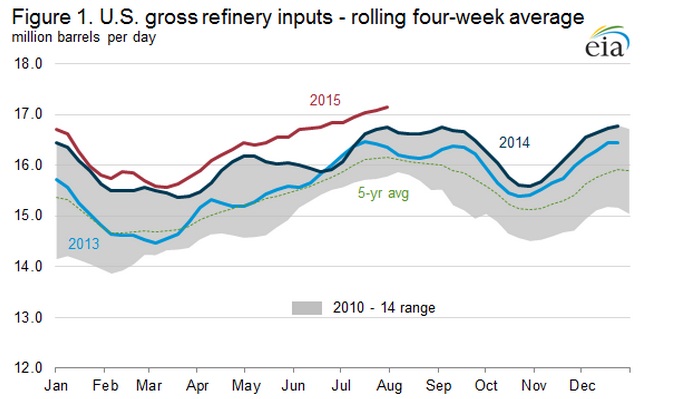

US refineries are operating very close to 100% capacity in a bid to gain from higher crack spreads prevailing across globe, thanks to lower crude prices.

What is crack spread?

- Roughly speaking, crude oil is not consumed in its raw form, instead it is refined in the refineries producing various products such as gasoline, Diesel etc. Price differential between raw crude price and the price of the end products are called crack spread. This is refinery margin, higher leads to higher profits for refineries.

With crude oil prices close to lowest in more than 6 years, and healthy demand from end users led to high global crack spread.

For example, this year on July 8th, Gasoline crack spread touched $0.66/barrel, which is highest since 2008. It has moderated somewhat since then, still enough for refineries to operate at high capacity.

US refineries are consuming more than 17 million barrels/day for past few weeks, while operating capacity stands at 18 million barrels/day.

Going ahead one concern remains that if the crack spread falls, US refineries might reduce their operating capacity leading to faster storage buildup and even spillover at Cushing, Oklahoma.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?