Yesterday S&P/Case-Shiller home prices were released in US, that showed housing market is still far from recovery and might not be strong enough to handle rate hikes by FED.

- US mortgage rates, especially the fixed rates have risen already in anticipation of rate hike by US Federal Reserve this year.

- While 30 year yield has to lend to US governments has been close to 2.5%, people are paying around 3.6%-4% for 30 year tenure prime mortgage. However Mortgage rates have somewhat eased 30 to 40 basis points from last year's high in 2014.

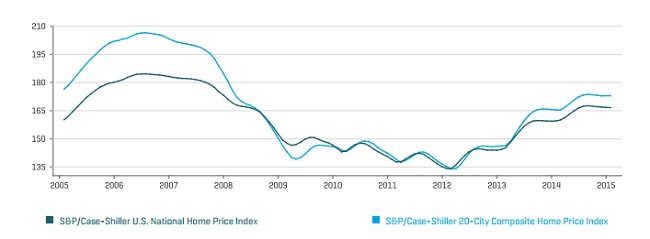

Chart attached explains home prices as measured by S&P/Case-Shiller index for national and 20 cities. S&P/Case-Shiller index is based on pioneering research of Robert Shiller and Karl Case, which tracks real estate prices across nations and generally considered as a leading indicator.

Latest reading shows further softening of home prices across nation.

- Index fell nationwide by -0.06%, whereas top 20 cities saw drawdown of -0.03% on monthly basis.

FED this year facing several hurdles to decide on rate hike mainly from weaker manufacturing and housing. Reports suggest that people are facing trouble to refinance their mortgages.

Weaker data from housing sector will continue to pose challenge for FED to decide on suitable rate hike path. Moreover, Charles Evans group might increase inside FOMC, who are calling for first rate hike in 2016.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings