Housing sector has one of the key factor that has been preventing FED hawks from raising rates this year. Housing, weak wage growth and weaker than expected inflation has remained three major pillars of worries.

However a stronger than expected rebound in housing market in second quarter of 2015 is definitely giving policymakers some relief as they are in search of a suitable to meeting to hike rates for the first time.

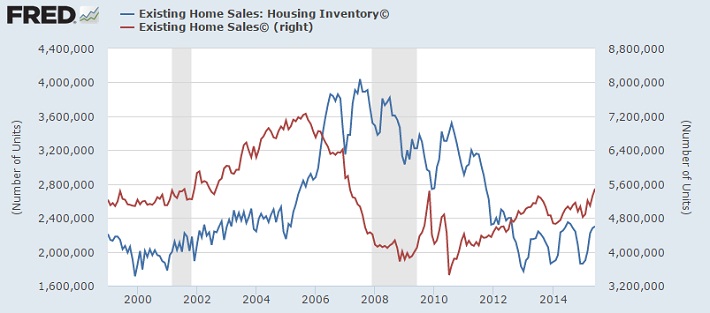

As evident from the chart, Housing sales have picked up sharply in 2015. In June existing home sales rose by 3.2% from May's level to 5.49 million, which stands as the fastest pace since 2007.

This may be lower than 7.25 million pace registered before crisis, but such level is not desirable as it can be said as the level of bubble.

While US labor market is yet to pick up pace in second quarter, housing definitely has.

The chart also shows that housing inventory which picked during 2007, just prior to the crisis has fallen close to level of 2001.

Dollar is likely to remain well bid heading into September, however volatility is likely to persist.