The RBA lowered its main interest rate to 1.75% from 2% on Tuesday, a new all-time low. The move surprised most market analysts, who anticipated no change in monetary policy. Dismal inflation data reported in April were seen as the main catalyst. A private sector gauge of consumer prices on Monday last week showed that Australia's core inflation weakened to 1.5% y/y in April, down from 1.7% in March, according to the Melbourne Institute.

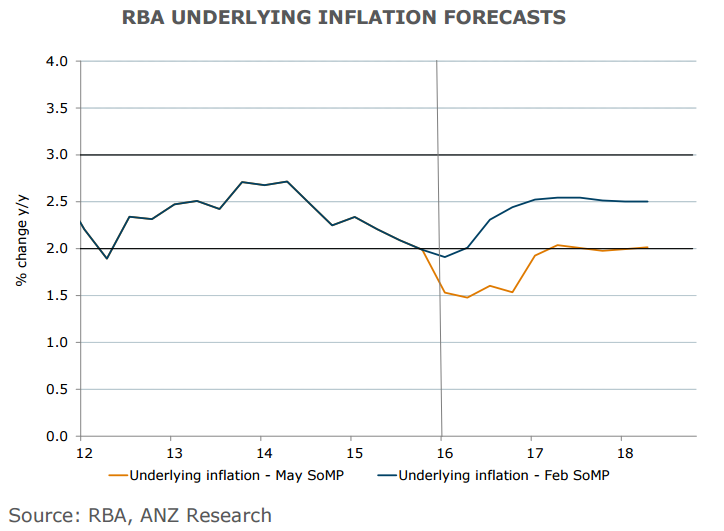

While the Q1 inflation number was weak, the RBA in its quarterly Statement of Monetary Policy (SoMP) released earlier today has cut its Dec-16 inflation forecasts by a full percentage point. Underlying inflation is now seen at 1-2 pct end 2016 (pvs 2-3 pct), 1.5-2.5 pct out to mid-2018 (pvs 2-3 pct). Inflation is set to miss its 2-3% target through the entire 2016 year. Outlook for wage growth was revised lower and is expected to stay low for longer and then rise very gradually.

In Australia wages are now growing at just over 2 per cent a year, and unit labour costs (wages adjusted for productivity) are growing at a trend rate of just 0.6 per cent a year. To get inflation safely back into the RBA's 2-3 per cent target zone, wages need to be growing at about their long-term rate of about 3.5 per cent a year.

The bank's new economic forecasts, published on Friday with its quarterly Statement on Monetary Policy, suggest that a further reduction in the cash rate is likely. Such a large downgrade to inflation suggests that further easing is almost guaranteed. The size of the downgrade to the inflation forecasts and the extent of adjustment required in real rates argue for a rapid shift down in the cash rate, and another cut in June.

The strategy of cutting interest rates to record lows has had mixed results in places like Japan and the Eurozone and it remains to be seen whether rock bottom interest rates could have the desired effect on Australia's persistently low inflation. Low inflation can be very persistent, especially when it is reinforced by low growth in wages which, in turn, are reinforced by the low inflation they generate.

"We now expect another 25bp cut, most likely in August, but the possibility of a cut as early as June shouldn’t be discounted," said ANZ in a report.

The ASX 200 Index closed 0.2% higher at 5,289.60 points, retracing earlier losses of as much as 1.5 percent. AUD/USD extended downside to hit fresh 2-month lows at 0.7358 and was trading at 0.7363 at 1130 GMT.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings