IMF chief's comments that a Greek exit from the eurozone is a possibility show that the country's creditors have tired of Syriza.

Christine Lagarde during a meeting of G7 finance ministers in Dresden reveals the weakness of the stance taken by the radical leftist syriza party which governs Greece in negotiations over the past four months.

Greek default to the ECB would be a serious blow to the Bank's credibility that could limit its ability to control inflation or support stressed bond markets in future.

If you Euro to spike up against pounds, then cover your underlying currency exposures on collars.

This strategy is for those who have Euro exposure or holds euro on sot at present who are concerned about a correction and wish to hedge the long spot currency position.

How do you do that? Well the hedger takes following positions constructs this strategy:

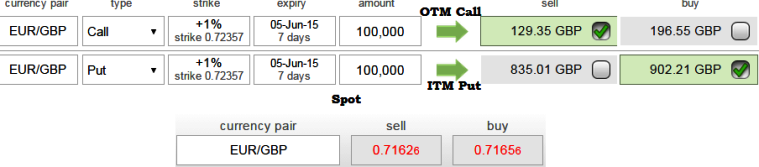

Write an OTM call option + hold an ITM put option (near month Call & mid month put)

This helps as a means to hedge a long position in the underlying currency.

IMF boss divulges weakness in Greece; Hedge Euro with collar

Friday, May 29, 2015 8:42 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate