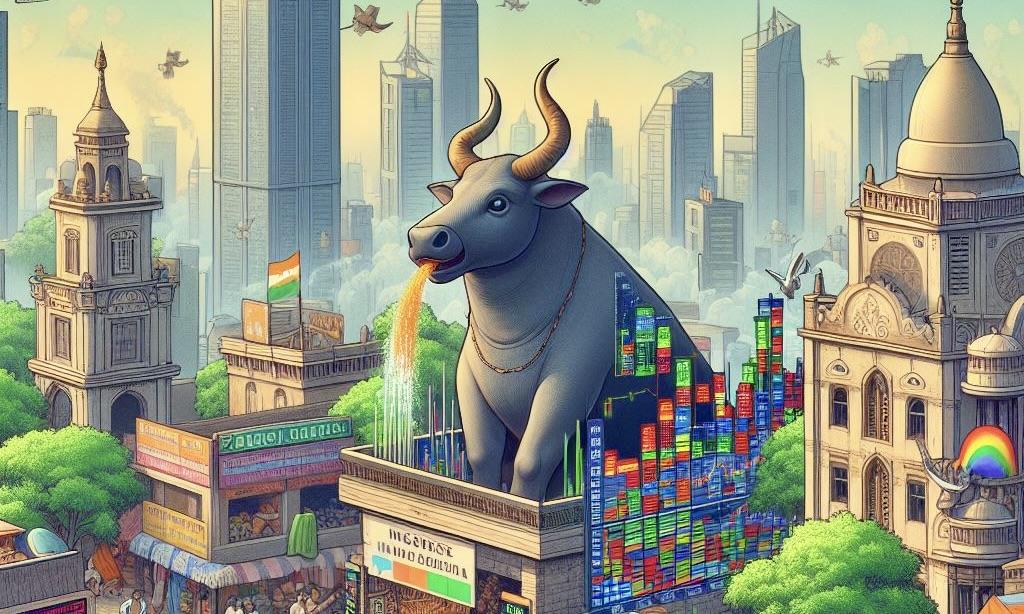

India's buoyant stock market is witnessing a surge in initial public offerings (IPOs), although concerns arise over the tepid performance of many listings in Mumbai.

Investors and analysts note the optimistic outlook for India's economic growth, bolstered corporate earnings, and robust demand from foreign investors, contributing to the momentum of deals. Dealogic data highlights that in January, 21 IPOs raised approximately $678 million, a stark contrast to the $17 million raised during the same period last year.

Growth Amid Valuation Concerns

Despite the promising trend, market analysts caution against elevated valuations, spurred by a 20% rise in India's benchmark Sensex stock index over the past year.

Kunal Vora, head of India equity research at BNP Paribas, acknowledges the positive fundamentals and growth prospects but underscores concerns regarding valuation levels. Noteworthy companies poised for IPOs include Ola Electric and the fintech group MobiKwik.

India's Ascendancy in the IPO Market

India's IPO market experienced revitalization last year, propelled by robust corporate earnings and heightened investor interest domestically and internationally.

This enthusiasm contributed to India's stock market capitalization reaching approximately $4 trillion, surpassing Hong Kong as the seventh-largest market globally. Additionally, Indian IPOs raised nearly $8 billion in funds last year, reflecting the country's emergence as a critical player in the global IPO landscape.

Economic Momentum and Investor Preference

India's economy has emerged as one of the fastest-growing globally, with an anticipated expansion of 7% this year. Geopolitical tensions and economic uncertainties surrounding China have fueled foreign investor interest in Indian stocks.

Concerns regarding IPO performance have prompted institutional investors in India to reassess their participation in new listings.

According to Financial Times, Raamdeo Agrawal, chair of the Indian financial group Motilal Oswal, emphasizes a preference for investments in publicly traded companies due to greater financial transparency and advocates against speculative IPO investments.

Moving Forward

Despite the cautious sentiment surrounding IPOs, the Indian market attracts significant attention from domestic and international investors.

According to Bloomberg, the surge in IPO activity underscores the growing confidence in India's economic prospects and its position as a key destination for investment.

As market dynamics evolve and regulatory frameworks adapt, stakeholders remain vigilant, seeking opportunities while navigating potential risks in India's vibrant IPO landscape.

Photo: Microsoft Bing

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains