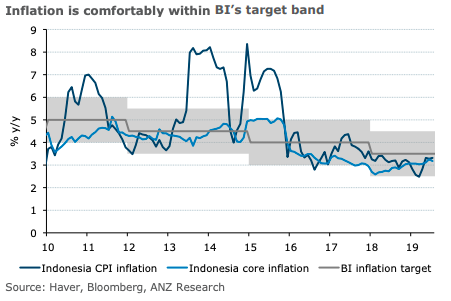

Indonesia’s inflation is likely to stay comfortably within the central bank’s 2.5-4.5 percent target band despite the higher than anticipated July print, according to the latest report from ANZ Research.

The country’s both headline and core CPI inflation beat consensus expectations. Headline CPI inflation edged up to 3.32 percent y/y in July, while core inflation softened less than expected to 3.18 percent y/y. An increase in the price of administered items offset softening core and flat volatile food inflation.

Four categories including foodstuffs, housing and utilities, prepared food and health which cumulatively account for around 65 percent of headline CPI recorded easing annual inflation. However, this was offset by increases in the clothing and transport components.

Notably, transport prices picked up to 2.2 percent y/y in July from 1.9 percent in June. In sequential terms, headline CPI rose by 0.31 percent m/m in July, lower than the 0.55 percent m/m increase in the prior month. The pace of increase eased in all components except for education.

Core CPI, which excludes volatile food and government-controlled prices, rose by 0.33 percent m/m in July, marginally lower than the 0.38 percent increase recorded in June. In y/y terms, core inflation eased to 3.18 percent y/y, from 3.25 percent in the previous month.

"The big picture is that inflation remains under control and comfortably within the central bank’s 2.5-4.5 percent target band. We continue to see scope for the policy rate to be lowered by 50bps over the coming quarters," the report further commented.

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook  Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes

Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes  Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty

Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty  China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy

China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy  Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets

Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets  Philippines Manufacturing PMI Hits Nine-Month High Despite Weak Confidence Outlook

Philippines Manufacturing PMI Hits Nine-Month High Despite Weak Confidence Outlook  Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.

Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.  India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations

India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations  Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions  Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions

Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons