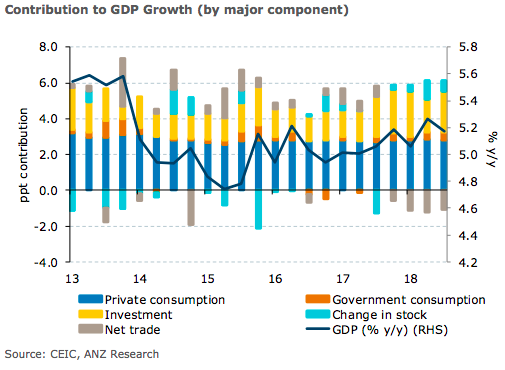

Indonesia’s growth slowed slightly from 5.27 percent y/y in Q2 to 5.17 percent in the third quarter of this year, which was broadly in line with expectations. Investment was a key driver of growth, with its pace of expansion picking up from 5.86 percent y/y in Q2 to 6.96 percent in Q3.

Government consumption growth also accelerated during the same period. Private consumption growth slowed, but it remained solid by recent standards. Inventories also provided a smaller lift to growth.

Meanwhile, export growth edged down, though a sharper moderation in import growth meant that net trade was a slightly smaller drag on growth in Q3 as compared to the quarter before. In year-to-date terms, GDP growth came in at 5.17 percent y/y, which suggests that ANZ Research’s full-year growth forecast for 2018 of 5.2 percent percent remains on track.

While the policy response to the weakening of the IDR in recent months has helped stabilise the currency, it is likely to be a constraint on growth. For instance, government measures to reduce imports by raising tariffs on selected consumer goods and delay import-intensive infrastructure projects will dampen domestic demand.

"Tightening liquidity conditions following the central bank’s cumulative 150bps in rate hikes since May also present a headwind to growth. Today’s GDP data is unlikely to have much bearing on monetary policy, which will continue to be driven by movements in the IDR. Recent gains in the IDR suggest Bank Indonesia (BI) is likely to stay on hold at its meeting next week," ANZ Research commented.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022