US Federal Reserve for months now, has been preparing financial markets for an imminent rate hike that is still expected to occur sometime this year.

- While Fed has not ruled out the possibility of June rate hike, the market based measure is pointing to sometime around November/December. It is not clear how treasury yields might react this time around when first rate hike takes place, as FED has huge balance sheet worth $4 trillion unlike other time.

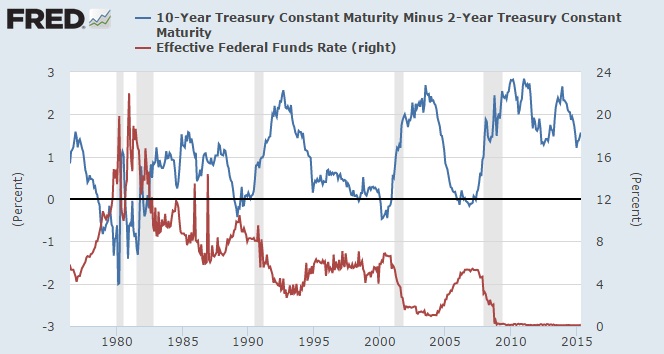

The above chart provide some historical cues how treasuries might react over rate hike by plotting the yield differential between 2 year and 10 year treasuries against Federal funds rate.

- As shown, yield differentials between 2 year and 10 year treasuries drop, when federal funds rate goes up.

- Rate differentials reach to the negative zone prior to peak prosperity followed by recession.

Federal funds rate have remain near zero since the financial crisis, so in this period yield differentials tend move taking cues from unconventional monetary policies.

As FED issued dovish comments in March meeting yield differentials have started going up in favor of 10 year.

So it can be kept in back of the mind that short end of the curve might outperform longer end once rate hike starts. That could be cues to start riding the dollar again.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings