Intel Corporation has called off its planned $5.4 billion acquisition of Israeli chipmaker Tower Semiconductor after failing to secure pivotal regulatory approval from China. This setback forces Intel to pay a $353 million termination fee and reevaluates its strategies against dominant rival Taiwan Semiconductor Manufacturing Co. The decision poses a significant challenge to CEO Pat Gelsinger’s growth blueprint.

This means that Intel Corporation already terminated its deal for the takeover of Tower Semiconductor. The American tech company based in Santa Clara, California, explained that it had dropped the proposed deal “due to the inability to obtain in a timely manner the regulatory approvals required under the merger agreement.”

According to CNBC, with the cancellation of the agreement, Intel will have to pay Tower a hefty $353 million as a termination fee. In February last year, the company revealed its intention to buy the Israeli chip manufacturing firm.

At any rate, it was reported that Intel could not secure the approval of the Chinese regulator for the deal. This is an important part of the acquisition process, but the deadline has passed without issuing the needed consent. As they hit this snag, Intel and Tower Semiconductor agreed to terminate their agreement.

“After careful consideration and thorough discussions and having received no indications regarding certain required regulatory approval, both parties have agreed to terminate their merger agreement having passed the August 15, 2023, outside date,” the Israeli chip company said in a statement.

Finally, Bloomberg reported that the failed buyout plan of Tower Semiconductor was considered the foundation of Pat Gelsinger’s, Intel’s chief executive officer, plan to penetrate the faster-growing part of the chip industry and foundry market, which is currently being dominated by Taiwan Semiconductor Manufacturing Co. (TSMC). Thus, the development was kind of a blow to Intel.

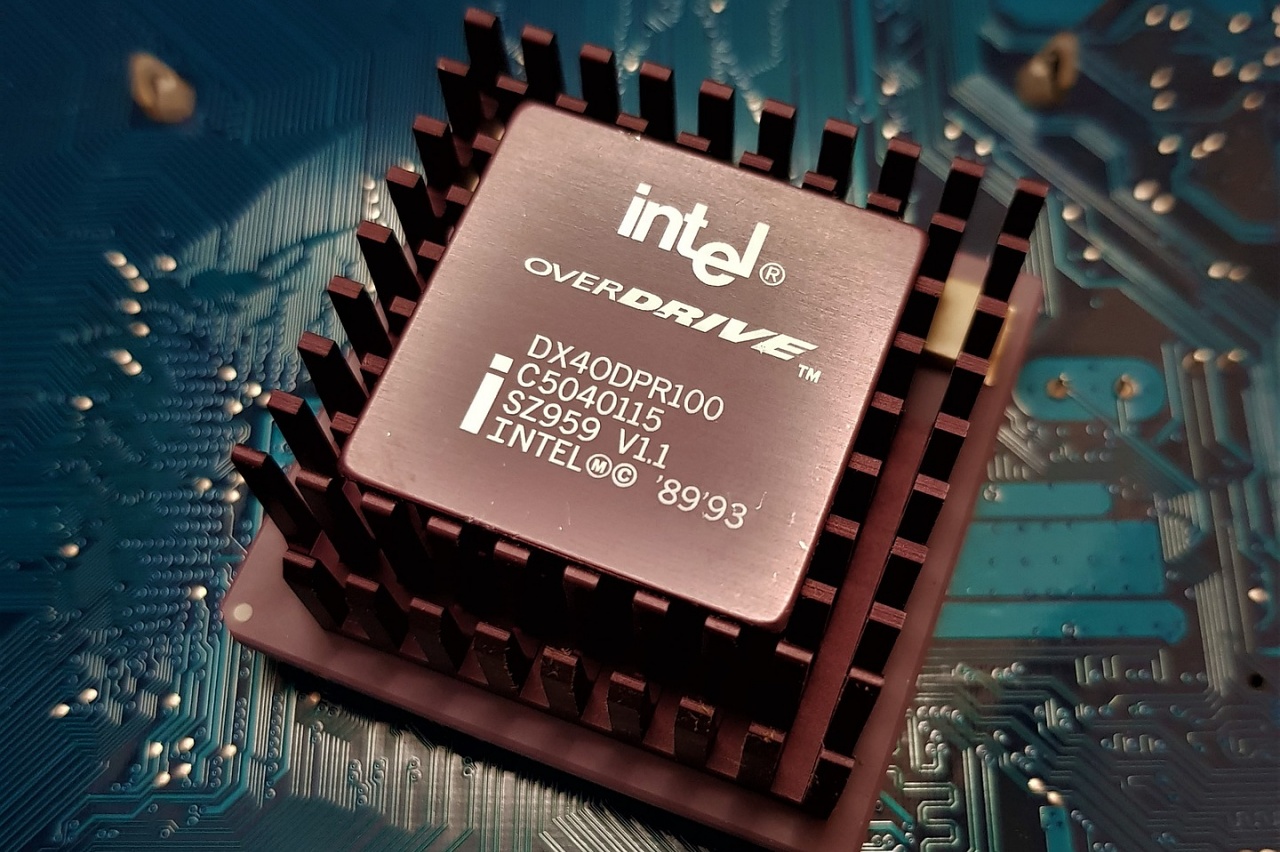

Photo by: Michael Dahlenburg/Pixabay

Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand

Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand  Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens

Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  Nvidia to Launch New AI Inference Processor to Boost OpenAI Performance

Nvidia to Launch New AI Inference Processor to Boost OpenAI Performance  Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand

Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand  Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook

Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook  U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street

U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street  Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules  U.S. Stock Futures Fall as Nvidia Drops Despite Strong Earnings; Netflix Jumps 9%

U.S. Stock Futures Fall as Nvidia Drops Despite Strong Earnings; Netflix Jumps 9%  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient

Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient