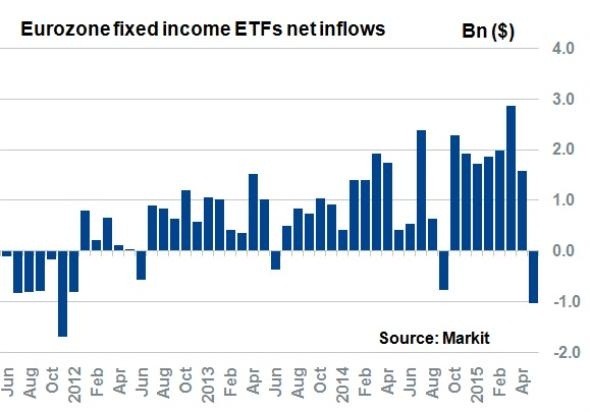

- Latest data from Markit economic show that bond investors are fleeing from European assets. European fixed income ETFs experiences total $1.03 billion outflow so far in May making it the largest since sovereign debt crisis of 2011/12.

- Only in march, when European Central bank started its asset purchase inflows had it record of $2.9 billion. Since September last year, investors have been pouring money into European fixed income, making this month's outflow as first of its kind since then.

- Bond market rout worldwide has hurt European sovereigns highest, even corporate bonds in Europe are experiencing better stability. European sovereign bonds have completely erased its gains made this year with German 10 year benchmark yields jumping from 0.05% to 0.75% in matter of weeks.

European Central Bank has low influence over longer term yields, however yields might hit ceiling if ECB shrugs of any concern and welcome the move as more fundamental and shows determination to continue with its massive purchase program.

Bank of England's (BOE) Governor Mark Carney has declared the move to be more fundamental driven as deflation fear subsides.

Rush to exit would gather pace if actual inflation rise across globe, which as of now showing little evidence of such.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand