Undoubtedly Chinese economy has slowed down considerably in past few years, as evident from many economic dockets, such as GDP (which has slowed to 7%, slowest in more than a decade), industrial production (from double digit growth to 6% as of last month).

However there may be more than ordinary visible slowdown, and if we keep staring at industrial production and construction to recover and move again to double digit pace, we might miss the actual recovery.

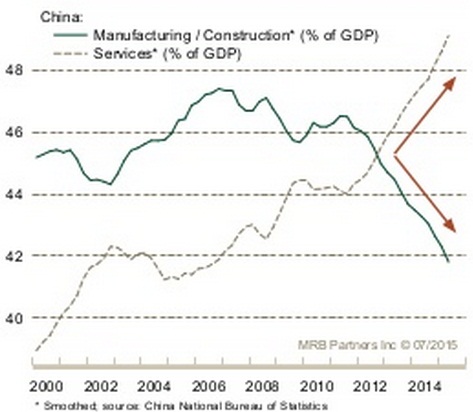

Chinese economy, as evident from the graph (chart courtesy Soberlook.com) is under major economic shift. The current has been there for quite some time now, but actually gathered pace since the crisis.

Before financial crisis of 2008/09, manufacturing and construction were contributing to more than 47% GDP and services back in 2000 were contributing less than 40% to GDP.

As of now, manufacturing and construction are contributing to less than 42% and it is likely to drop further and services are closing in to contribute almost 50% to China's total GDP.

This week PBoC attempted to improve the odds in favor of China's ailing manufacturing via three consecutive Yuan devaluation (-1.9% on Tuesday and -1.6% and -1.1% thereafter). It might improve competitive advantage for Chinese products but underlying shift is unlikely to change.

China is clearly shifting from global manufacturing hub to a service oriented economy and manufacturing is likely to play lesser role over the coming years.

So it is of high importance that we bring services indicators, which have been showing considerable strength (China services PMI in July at 53.8, highest in almost a year) into our radar along with the manufacturing ones.

ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth

ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements

Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion  Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher

Oil Tanker Attacks in Gulf Escalate U.S.–Iran Conflict, Driving Energy Prices Higher  KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally

KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally  EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy