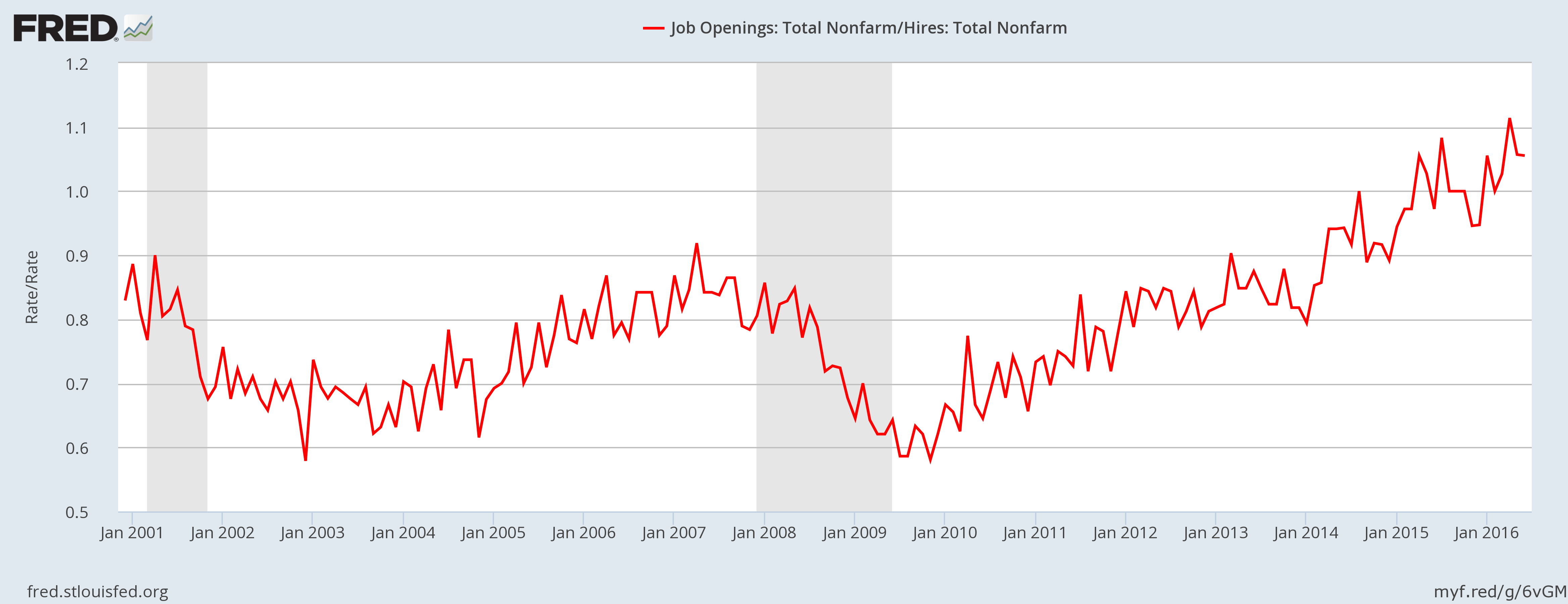

Latest data from JOLTS points at a deterioration in employment suitability ratio. This is a simple ratio calculated from the data of total job openings to total hires. Whenever the number reaches above 1, it means the economy is close towards maximum employability. It means that there are more job openings than hires, which basically means due to lack of suitable candidates, positions are not being filled. In the past 15 years of history (records go till 2001) this number has never gone above 1. This year, it has remained above 1.

This issue of structural unemployment can’t be solved by monetary easing. This could also lead to higher wages in some sections of the economy where the shortage of skilled labor is acute. The problem can be addressed mainly via two ways; one would be to introduce courses to improve skills and that would require some form of a fiscal stimulus cum reforms and the other one would be through immigrations, which is to bring in the skilled workers from outside. Given the political promises in this year’s election, the second one doesn’t seem to be an option and lawmakers in the U.S. don’t seem determined enough to pursue the reforms or the fiscal dosages needed. Hence this structural unemployment is here to stay in the States.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears