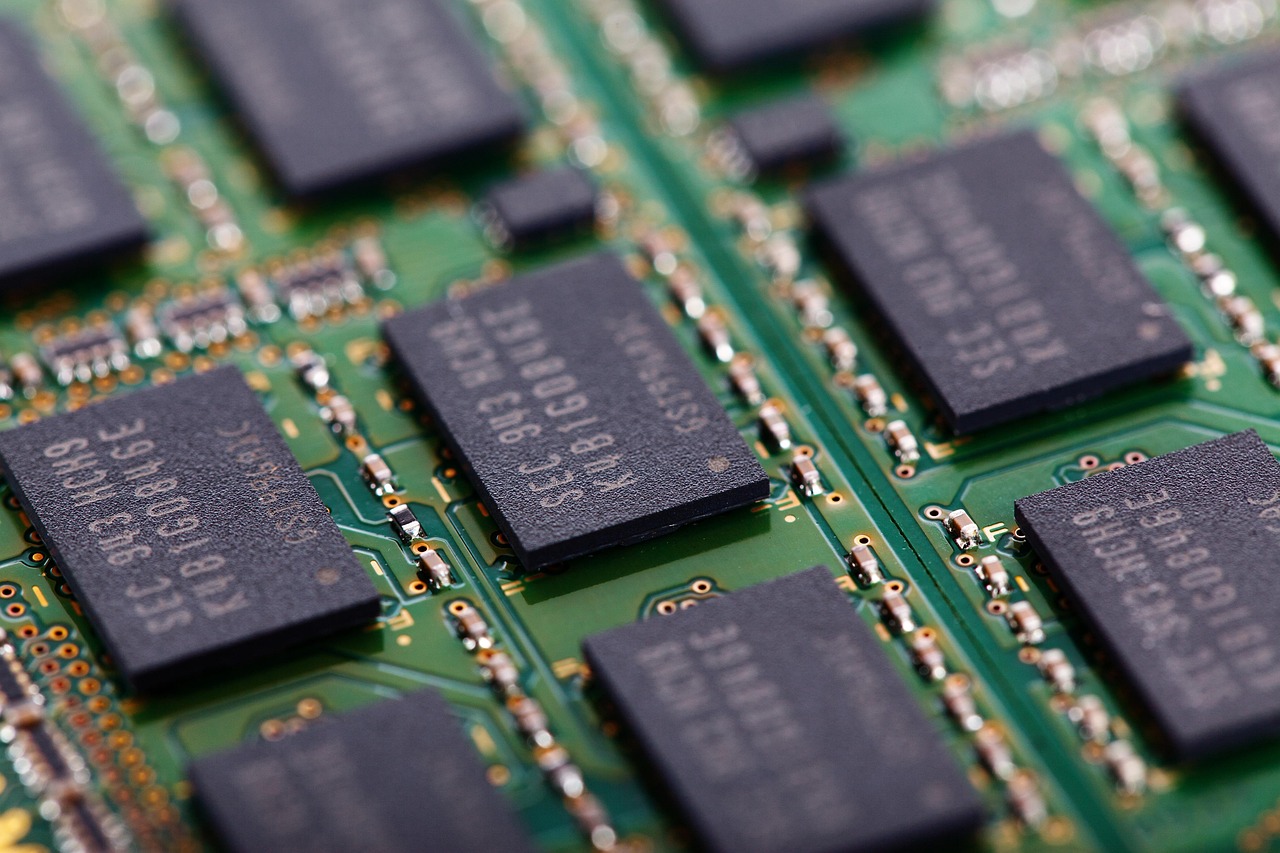

Japan is considering a major move to reduce its trade imbalance with the United States by purchasing up to 1 trillion yen ($6.94 billion) worth of American-made semiconductors, according to a report by Asahi newspaper. The initiative is part of ongoing tariff negotiations between the two nations, with Japanese officials aiming to ease U.S. concerns over the nearly 10 trillion yen trade deficit.

The plan, still under discussion, involves subsidizing domestic Japanese companies to buy U.S. semiconductor products, notably from leading tech firms such as Nvidia (NASDAQ:NVDA). The effort highlights Japan’s strategic push to align more closely with American trade interests while strengthening its own high-tech industry amid growing global chip demand.

The proposal comes as part of broader economic talks and is seen as a gesture of goodwill toward the Biden administration, which has maintained a firm stance on tariffs since taking office. Japan’s Economic Revitalization Minister Ryosei Akazawa, who is leading the tariff negotiations, is scheduled to visit the United States around May 30 for the fourth round of discussions. The talks are expected to cover trade imbalances, supply chain resilience, and tech sector cooperation.

Analysts say the move could not only narrow the trade gap but also secure more favorable terms in future U.S.-Japan economic agreements. Japan’s potential commitment to U.S. chip imports aligns with Washington’s broader strategy to secure global semiconductor supply chains and support its domestic chip industry through international collaboration.

By targeting semiconductor imports, Japan aims to both satisfy U.S. trade demands and ensure domestic industries remain competitive in the rapidly evolving tech landscape. The proposal, if finalized, would mark one of the largest Japanese tech import pledges in recent years.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering