Year 2016 signifies a period that will test the intrinsic value of Abenomics, which is entering its fourth year. Japan's recovery remains shaky three years after Prime Minister Shinzo Abe's trademark policies trying to reignite the economy. Japan narrowly escaped a second recession under the Abe administration and its landscape still remains a mixed picture.

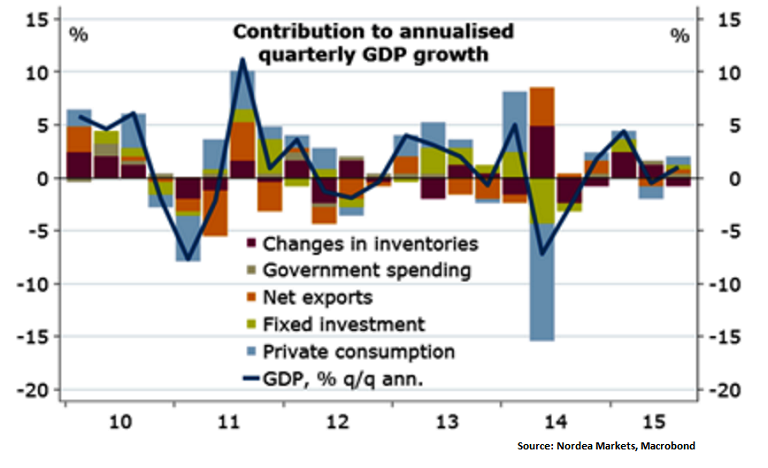

A combination of challenging demographics, weak productivity growth, sluggish external demand and fiscal drag cloud the outlook for Japan. The prerequisite for any meaningful and sustainable base salary increase is labour market reform and half-hearted efforts to implement key structural reforms, darken the prospect of a convincing turnaround. Consistently disappointing wage growth has played a more crucial role in dampening consumers' willingness to spend. Consequently, household consumption which is the most important growth drivers in Japan has delivered a mixed performance in the past two years.

Japan's productivity growth has been idle below 2% for more than two decades and changing the labour laws, as mentioned above, could enhance efficiency as permanent workers are typically overpaid relative to their productivity. Japanese corporates have been investing outside of Japan, due to tax reasons and higher productivity growth. To address this issue, Premier Abe has vowed to cut the high corporate taxes by at least 3.3% points this year. This could give a modest pick-up in investment in 2017.

"We have kept our forecast almost unchanged from our September outlook and expect 1% GDP growth this year. Next year, the sales tax hike from 8% to 10% is likely to hurt consumption, causing growth to dip to 0.6%", says Nordea Markets in a research report.

Bank of Japan has in the recent months laid larger emphasis on the underlying inflation, ie CPI excluding fresh food and energy, instead of CPI excluding fresh food. The new "core" inflation has risen to 1.2% in November, which is in line with governor Kuroda's optimistic view of a positive inflation trend. In its Oct meeting the BoJ has made it clear that although the 2% inflation target remains, it will continue with a lenient attitude towards achieving the target. USD/JPY was trading at 117.66 as of 1130 GMT.

"In the wake of the revised BoJ view, we have changed our forecast for the JPY, seeing now a stronger JPY across the horizon both against the USD and the EUR. Other factors supporting JPY strength include the current account surplus and Japan's safe-haven status, which tend to strengthen the JPY sharply when risks in Asia heighten," added Nordea Markets

Japan's outlook for 2016 still remains a mixed picture

Thursday, January 14, 2016 11:41 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate