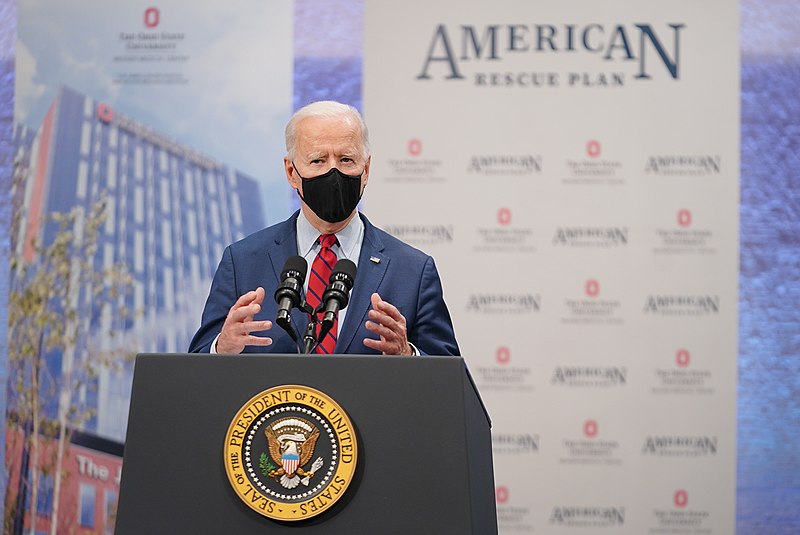

With the passage of the $1.9 trillion COVID relief proposal, the plan aims to cut child poverty in half. President Joe Biden announced that the child tax credit payments to families will begin by July.

The White House released a short statement from Biden regarding the provision of the plan, which looks to cut child poverty in half. Biden also urged Congress to pass his American Families Plan that will see the expansion of the child tax credit. Biden’s statement comes after the announcement made by the US Treasury, that Americans with children may begin to receive their child tax credit payments starting July 15.

“With today’s announcement, about 90% of families with children will get this new tax relief automatically, starting in July. While the American Rescue Plan provides for this vital tax relief to hard-working families for this year, Congress must pass the American Families Plan to ensure that working families will be able to count on this relief for years to come,” said Biden in the statement.

Almost 88 percent of children are going to receive the benefits without the need for their parents to take any additional action. Qualified families will be able to receive up to $300 a month for each child under six years old and $250 for children between six to 17 years old. The child tax credit was previously capped at $2000 and was originally only paid out to families that have income tax obligations.

However, for 2021, couples that earn less than $150,000 can receive the full payments every 15th of the month, mostly in direct deposits. Annually, the benefits for children under six years old amount to $3600 and for children between 6 to 17 years old, $3000.

In other news, Biden has continued with the tradition of presidents publicizing their financial records. Biden and first lady Dr. Jill Biden released their tax returns for 2020, the couple making over $600,000 and paid $157,414 of income tax. This amounts to a 25.6 percent federal income tax rate for the Bidens.

The Bidens also paid $28,794 in income taxes to their home state of Delaware. They were also reported to having donated $30,704 to 10 different charities.

AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption

EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  Suspected Drone Strike Hits RAF Akrotiri Base in Cyprus, Causing Limited Damage

Suspected Drone Strike Hits RAF Akrotiri Base in Cyprus, Causing Limited Damage  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  Pentagon Leaders Monitor U.S. Iran Operation from Mar-a-Lago

Pentagon Leaders Monitor U.S. Iran Operation from Mar-a-Lago  Trump Says U.S. Attacks on Iran Will Continue, Warns of More American Casualties

Trump Says U.S. Attacks on Iran Will Continue, Warns of More American Casualties  Australia Rules Out Military Involvement in Iran Conflict as Middle East Tensions Escalate

Australia Rules Out Military Involvement in Iran Conflict as Middle East Tensions Escalate  Macron Urges Emergency UN Security Council Meeting as US-Israel Strikes on Iran Escalate Middle East Tensions

Macron Urges Emergency UN Security Council Meeting as US-Israel Strikes on Iran Escalate Middle East Tensions  Israel Launches Fresh Strikes on Iran After Death of Supreme Leader Ayatollah Khamenei

Israel Launches Fresh Strikes on Iran After Death of Supreme Leader Ayatollah Khamenei  Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East

Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East  UK Accepts U.S. Request to Use British Bases for Defensive Strikes on Iranian Missiles

UK Accepts U.S. Request to Use British Bases for Defensive Strikes on Iranian Missiles  U.S. Deploys Tomahawks, B-2 Bombers, F-35 Jets and AI Tools in Operation Epic Fury Against Iran

U.S. Deploys Tomahawks, B-2 Bombers, F-35 Jets and AI Tools in Operation Epic Fury Against Iran  Trump Says U.S. Combat Operations in Iran Will Continue Until Objectives Are Met

Trump Says U.S. Combat Operations in Iran Will Continue Until Objectives Are Met  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes

Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes