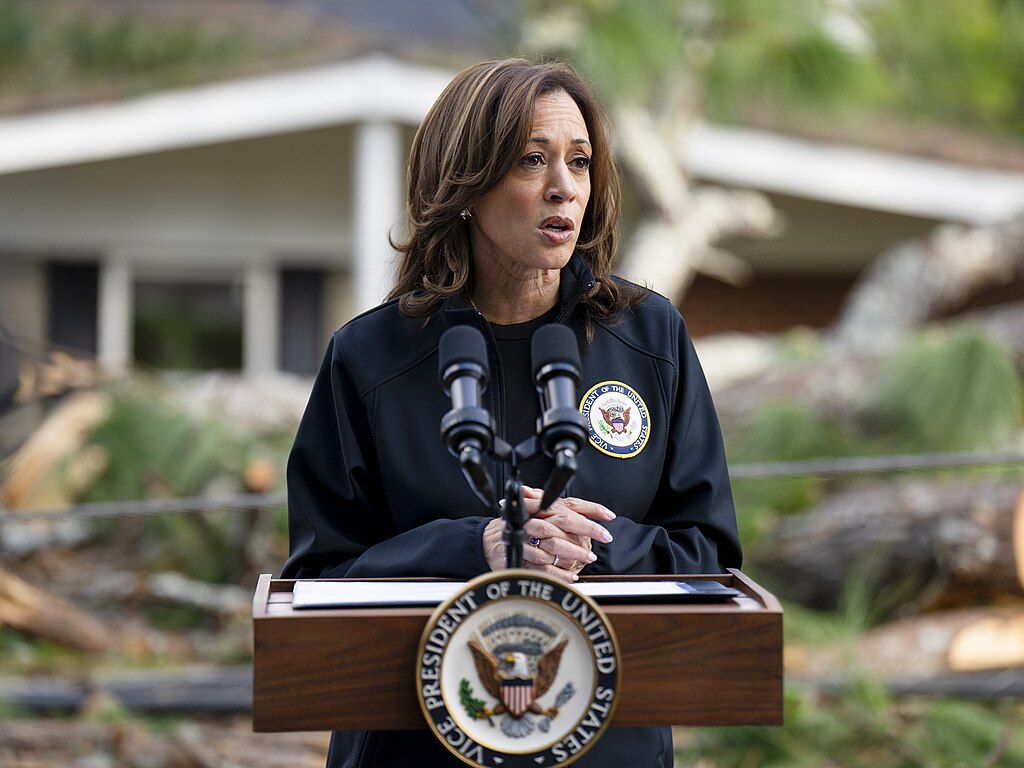

In 2025, Vice President Kamala Harris has unveiled a comprehensive tax reform agenda aimed at addressing income inequality and funding social programs. Her proposals focus on increasing taxes for high-income individuals and corporations while providing relief to middle- and lower-income families.

Tax Increases for High Earners and Corporations

Harris proposes raising the top marginal income tax rate for individuals earning over $400,000 annually. Additionally, she advocates for increasing the corporate tax rate from 21% to 28%, aiming to generate revenue for infrastructure and education initiatives.

Capital Gains and Estate Tax Reforms

The plan includes taxing long-term capital gains at ordinary income rates for individuals with incomes exceeding $1 million, effectively raising the top rate to 28%. Harris also supports tightening estate tax provisions by lowering the exemption threshold and increasing rates for large inheritances.

Expanded Tax Credits for Middle- and Lower-Income Families

To support working families, Harris proposes reinstating the expanded Child Tax Credit, providing up to $3,600 per child, and increasing the Earned Income Tax Credit for childless workers. These measures aim to reduce child poverty and provide financial relief to low-income households.

Public Reaction

Harris's tax reform proposals have sparked diverse reactions:

-

@TaxPolicyAnalyst: "Harris's plan to increase taxes on the wealthy is a step toward reducing income inequality."

-

@SmallBizOwner2025: "Raising corporate taxes could hurt small businesses struggling to recover in this economy."

-

@MiddleClassMom: "Expanded Child Tax Credit would be a lifesaver for families like mine."

Conclusion

Vice President Kamala Harris's 2025 tax reform agenda seeks to balance increased taxation on high earners and corporations with expanded support for middle- and lower-income families. As these proposals move through the legislative process, they are expected to generate significant debate regarding their potential economic impact and effectiveness in addressing income disparities.

Israel Strikes Hezbollah Targets in Lebanon After Missile and Drone Attacks

Israel Strikes Hezbollah Targets in Lebanon After Missile and Drone Attacks  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  U.S. Lawmakers Question Trump’s Iran Strategy After Joint U.S.-Israeli Strikes

U.S. Lawmakers Question Trump’s Iran Strategy After Joint U.S.-Israeli Strikes  Pentagon Downplays ‘Endless War’ Fears After U.S. Strikes on Iran Escalate Conflict

Pentagon Downplays ‘Endless War’ Fears After U.S. Strikes on Iran Escalate Conflict  U.S. Deploys Tomahawks, B-2 Bombers, F-35 Jets and AI Tools in Operation Epic Fury Against Iran

U.S. Deploys Tomahawks, B-2 Bombers, F-35 Jets and AI Tools in Operation Epic Fury Against Iran  Trump’s Iran Strikes Spark War Powers Clash in Congress

Trump’s Iran Strikes Spark War Powers Clash in Congress  U.S.-Israel War on Iran Escalates as Gulf Conflict Disrupts Oil, Air Travel and Regional Security

U.S.-Israel War on Iran Escalates as Gulf Conflict Disrupts Oil, Air Travel and Regional Security  Trump Announces U.S. Strikes on Iran Navy as Conflict Escalates

Trump Announces U.S. Strikes on Iran Navy as Conflict Escalates  Rubio Says U.S. Would Not Target School After Deadly Iran Strike Reports

Rubio Says U.S. Would Not Target School After Deadly Iran Strike Reports  AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  Russia Signals Openness to U.S. Security Guarantees for Ukraine at Geneva Peace Talks

Russia Signals Openness to U.S. Security Guarantees for Ukraine at Geneva Peace Talks  Melania Trump Chairs Historic U.N. Security Council Meeting on Children Amid Iran Conflict

Melania Trump Chairs Historic U.N. Security Council Meeting on Children Amid Iran Conflict  Trump to Attend White House Correspondents’ Dinner 2026, Ending Long Boycott

Trump to Attend White House Correspondents’ Dinner 2026, Ending Long Boycott  EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption

EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption  Suspected Drone Strike Hits RAF Akrotiri Base in Cyprus, Causing Limited Damage

Suspected Drone Strike Hits RAF Akrotiri Base in Cyprus, Causing Limited Damage  UK Accepts U.S. Request to Use British Bases for Defensive Strikes on Iranian Missiles

UK Accepts U.S. Request to Use British Bases for Defensive Strikes on Iranian Missiles