U.S. President Donald Trump on Sunday suggested that revenue from his new trade tariffs could enable income tax cuts for Americans earning less than $200,000 a year. Posting on Truth Social, Trump claimed that when tariffs "cut in," many individuals could see their income taxes "substantially reduced, maybe even completely eliminated," with a focus on middle- and lower-income earners.

Trump’s comments come just days ahead of the May 2 deadline for full implementation of steep tariffs on Chinese imports. Early signs of the tariffs' effects are already evident, as Chinese e-commerce giants Temu and Shein raised prices for U.S. consumers last week. A Bloomberg report highlighted that U.S. customs duty collections jumped over 60% in April, generating at least $15.4 billion following the initial round of Trump’s tariffs.

Despite the surge, tariff revenues remain a small portion compared to federal income tax collections. Treasury Department data show that as of fiscal 2025, the U.S. government has collected approximately $2.26 trillion in taxes, with more than half coming from individual income taxes. To meaningfully offset income taxes as Trump proposes, customs revenue would need to grow substantially.

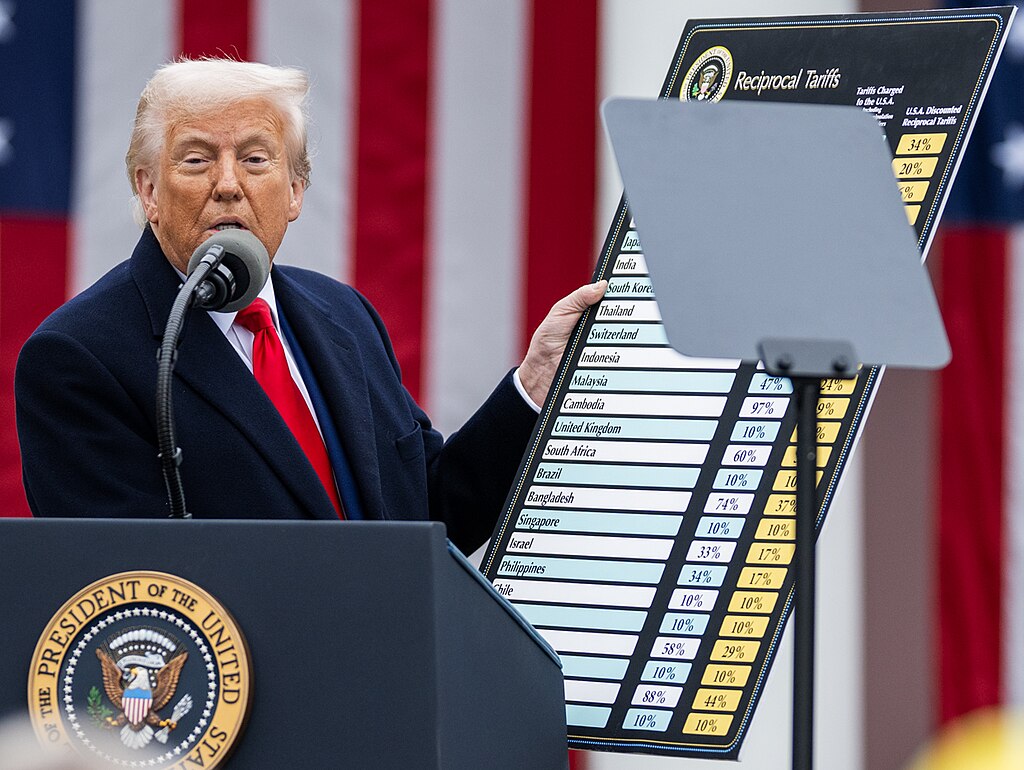

Earlier this month, Trump announced sweeping tariffs on major U.S. trading partners but delayed many after facing backlash. However, he moved forward with a sharp hike on Chinese goods, imposing tariffs up to 145%, escalating tensions between the world’s two largest economies. The trade war's long-term impact on U.S. consumers and the economy remains uncertain, as higher import costs could weigh heavily on American households, even as Trump promises tax relief.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit