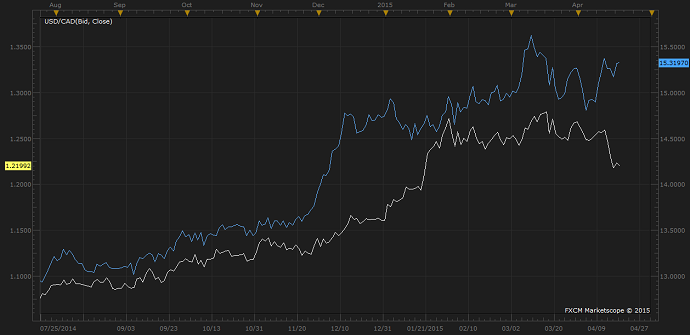

Canadian dollar has further gained grounds against Mexican peso, after Dollar/Loonie pair taken out important support area at 1.235-1.24.

- Mexico's economic gloom remains hard to end with. Inflation as of now is under control just below 3% target of central bank. However Peso's drop against dollar is expected to put pressure on inflation over coming months. Peso is hovering close to all time high, now at 15.3 against dollar.

- Government is taking up austerity measures to balance the budget, which this year is expected to get reduced by 1.5% of GDP.

Mexico's economy is not much gloomy and moves in tandem with US, however things are different this time, which puts peso vulnerable to Loonie.

- US refineries will be exporting heavy crudes from Canada, whereas Mexico will be searching for buyers elsewhere probably in Asia and Europe.

- Mexico has large sum of dollar denominated debt running close to $150 billion issued by private sector borrowing, which is at risk with dollar rising against peso.

Technically speaking loonie has closed above 2 month high against Peso, trading at 12.55. Resistance lies at 12.8-13. Rise towards all time high of 14 can't be ruled out.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate