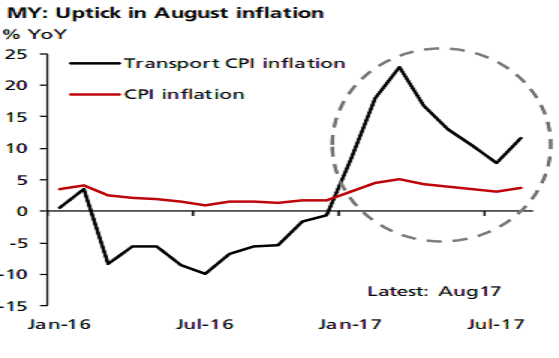

Malaysia’s consumer price-led inflation index (CPI) for the month of August surprised on the upside after four consecutive months of decline, headline CPI inflation picked up in August to register 3.7 percent y/y, from 3.2 percent previously.

The uptick can be mainly attributed to higher oil prices. Transport inflation was up by 11.7 percent compared to the same period last year. The prices of RON95 and RON97 petrol were 21 percent and 13.8 percent higher compared to the same period last year.

Moreover, overall transport CPI index has also risen by about 4 percent relative to July due to upward adjustments in pump prices. Indeed, transport inflation is still the main driver and it will continue to have a strong influence on overall inflation in the coming months. Yet, policymakers can take comfort that underlying inflationary pressure has remained benign, with core inflation at 2.4 percent in the month, and fairly stable in recent months.

"That probably explains why Bank Negara has kept the policy rate unchanged at 3.00 percent thus far even though real policy rate is negative. In fact, we continue to expect Bank Negara to keep the OPR at 3.00 percent for the rest of the year," DBS Bank commented in its latest research report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm