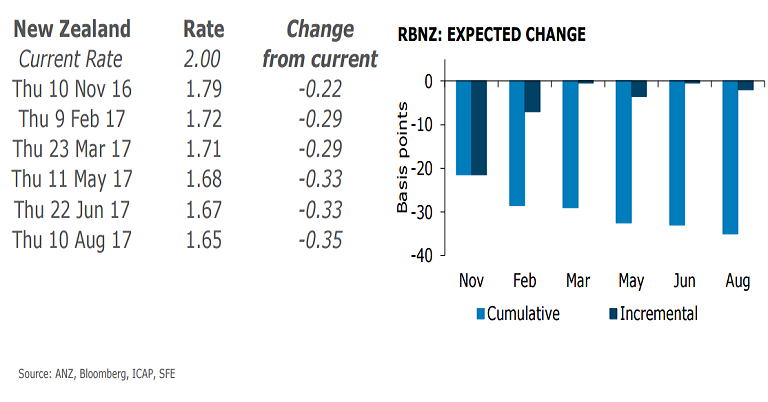

The Reserve Bank of New Zealand (RBNZ) stood pat at its monetary policy meeting in September, leaving the OCR unchanged at 2.00 percent. In the statement that followed, the RBNZ acknowledged the economic developments since August and the rise in the NZ dollar which was more than expected.

After the central bank’s meeting, market pricing for a November OCR cut has risen. RBNZ Assistant Governor McDermott this week reminded all that another cut was in the pipeline, by including the September meeting’s policy guidance sentence in a speech he gave on inflation.

New Zealand economic activity is strong, and the NZD has started to weaken against the USD since its multi-month peaks of 0.7485 hit on September 7th. New Zealand's Quarterly Survey of Business Opinion earlier this month reiterated the domestic economy appears in good shape.

Growth is stronger but inflation remains subdued. Pricing reports in NZ Quarterly Survey of Business Opinion were broadly consistent with muted CPI outcomes for Q3 and probably Q4 too, raising probability for rate cut by RBNZ at November meet. Q3 CPI updates are due this Tuesday, 18th October.

Analysts at Westpac note that the market pricing for an RBNZ’s November OCR cut has firmed over the past week, from 68% to 84%. Westpac says Q3 CPI will probably print somewhere in the 0.0%-0.2% range - and well outside its target range of 1%-3% (with an emphasis on the 2% midpoint).

"We do not expect the RBNZ to delay the signalled rate cut until the following meeting in February, partly because the gap between the November and February meetings is unusually large. After November, the RBNZ should remain on hold at 1.75% for some time, but needs to keep an easing bias dangling if it wants to avoid an adverse market reaction,” said Westpac in a report.

NZD/USD was trading at 0.7097 at around 11:00 GMT. The pair has taken support at major trendline at 0.7030. Major trend is still lower, a break below trendline support at 0.7030 could see drag upto 0.6985 and then 0.6951 levels. 100-day MA at 0.7166 is major resistance and only a break above could see resumption of upside in the pair.

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings