Mexico's economy has lost steam in 2016 and the outlook has become cloudier with the upcoming US elections stoking uncertainty about future economic relations between the two nations. The Mexican economy expanded at a solid rate of +0.5 percent (revised) in Q1 2016 on the previous quarter but was unable to maintain the momentum into Q2, when the economy contracted -0.2 percent.

The North American Free Trade Agreement (NAFTA) has so far helped the commodity-exporting country to alleviate the negative effects of the oil price slump. US Republican Presidential candidate, Donald Trump has criticized the NAFTA as being responsible for the losses of manufacturing jobs in the United States. Trump has said that he will build a wall along Mexican border; as a matter of fact this is one of his signature policies and he has said that Mexico would pay for it, failing which he might consider retaliation in terms of the trade deals.

Mexico’s industrial production is expanding at a sluggish rate as manufacturing softens due to subdued exports. In the first half of this year, industrial production growth averaged 0.7 percent, a tad lower than the average rate of growth in the second half of 2015. Both the figures are considerably weaker than the average witnessed in the past several years. Data released last Friday showed that Mexico's July industrial output y/y decreased to -1 percent from a previous 0.60 percent.

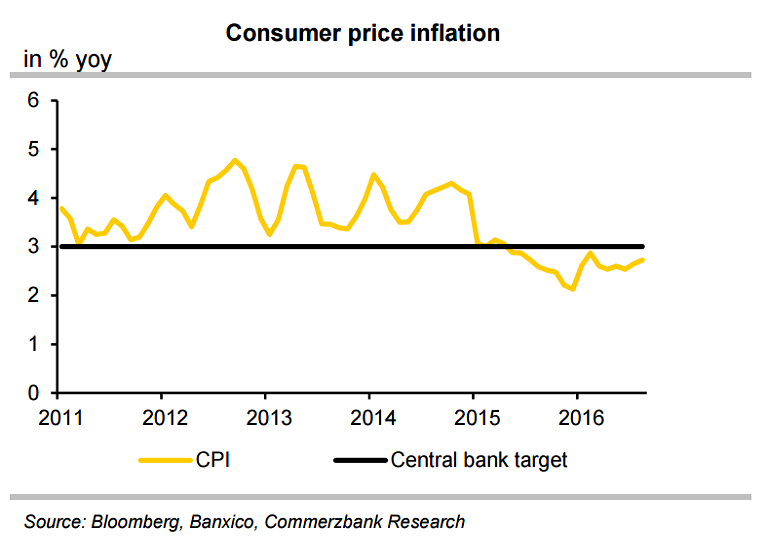

Low oil price, the sharp rise in interest rates and the government’s spending cuts pose considerable headwinds to the Mexican economy. Consumer price inflation has been trending sideways recently. In August, it stood at 2.8 percent compared with the previous year, still hovering in the lower half of the central bank’s target corridor of 2-4 percent. The Mexican peso was stuck in a sharp downward trend in 2015, but so far, has been unable to accelerate inflation to any noteworthy extent.

The Banxico is apparently seeking to put a cap on the crucial exchange rate versus the dollar so as to counteract inflation risks early on. To this end, Banxico raised its key interest rate by 125bp to 4.25 percent between December and June. Nonetheless, the peso has not profited. This year the peso has been one of the underperforming currencies in LatAm and indeed in the wider EM space.

"We do not expect the economy to regain momentum before 2017. We expect the inflation rate to remain well within this band in 2016 and 2017. We expect Banxico to raise its key rate to 4.5% by year end 2016, presumably in step with the Fed." said Commerzbank in a report.

USD/MXN slightly weaker on the day as poor US economic data released overnight cement Fed rate hike expectations for September, keeping the US dollar subdued. The pair was trading 0.14 percent lower on the day at around 19.3191 at 0900 GMT.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target