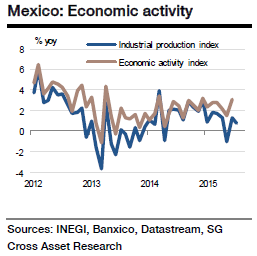

Economic activity in Mexico has surprised on the upside in recent months considering the slowdown in industrial production. However, the recent trade and IP numbers put supply side growth close to 2.1% yoy in August. Based on our assumption of slight acceleration in September of 2.4%, we still get a supply side growth deceleration in Q3 of 2.1% yoy and a 1.6% qoq annualised rate (2.3% and 2.5% respectively in Q2).

On a trend basis, therefore, growth continued to decelerate in both Q2 and Q3 and brings significant downside risk to the 2015 growth forecast of 2.3%. In terms of the industrial production details, the bulk of the weakness was caused by the falling mining production on lower oil production while the manufacturing sector appears stronger than other components (with the exception of the June figure).

These numbers are in sharp contrast to demand side indicators such as private consumption, which is showing significant growth acceleration this year. Not only does this mismatch raise doubts about recent growth numbers, but it also raises the scope for significant forecasting errors.Recent weakness aside, the IP improvement since last year has largely been driven by strengthening US growth and a jump in vehicle exports. Mexico's real export growth has surged impressively on average. The improvement in the competitiveness of exports - and, therefore, stronger investment growth - was achieved via lower wage growth in a weak labor market and should be helped by the weakening peso , says Societe Generale.

"A stronger manufacturing and trade gains is expected in Q4 15 and in 2016, boosting the rest of the economy via the investment, employment, wage and sentiment channels. Improvement in IP growth through the remainder of this year should help the economy grow to its potential in Q4 15 and then to strengthen in 2016. Currently, we expect the Mexican economy to grow by 2.3% in 2015 and 3.1% in 2016. However, we do recognise there are some downside risks to these numbers", estimates SocGen.

Mexico's economy slowing down further in Q3

Monday, October 26, 2015 6:04 AM UTC

Editor's Picks

- Market Data

Most Popular

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock