Reserve Bank of Australia (RBA) earlier today released minutes of the July meeting when interest rates were held unchanged at 1.75%. Minutes highlighted the central bank policy is not on a preset course and reiterated the data dependency of the central bank.

The Board repeated its warning than an appreciating exchange rate could complicate the outlook. The Australian dollar had appreciated against the US dollar and in trade-weighted terms over the past month, having been affected by changing expectations about the future path of monetary policy in Australia.

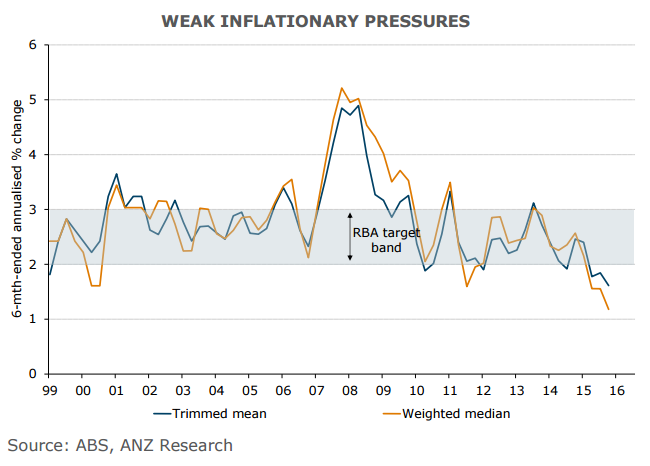

The members said that any future moves would be data-dependent, especially since inflation remains below the target range. The minutes said that “further information on inflationary pressures, the labour market and housing market activity would be available over the following month and that the staff would provide an update of their forecasts ahead of the August SoMP allowing the Board to refine its assessment of the outlook and to make any adjustment to the stance of policy that may be appropriate”.

The RBA was not fazed by Brexit and believed it was too soon to judge the effect of Brexit on the UK economy, which would be tempered by the depreciation of the GBP. The board noted that the direct effect of Brexit on Australia was “likely to be quite small” given limited trade links.

However, the RBA seems slightly less confident about the domestic outlook. It noted that indicators for consumer spending and the housing market had been mixed and that the underemployment rate had not fallen as much as the unemployment rate over the past year. The RBA also highlighted that all measures of inflation expectations were below average.

Q2 CPI data (to be released on Wednesday 27 July) are keenly awaited. Underlying inflationary pressures are expected to have remained subdued, and well below the RBA’s 2-3% policy target band. While the quarterly outcomes are forecast to be somewhat higher than in Q1, the average of the two core measures is forecast to decelerate to 1.4% y/y in Q2 from 1.5% y/y in Q1.

"We narrowly favour a 25bp rate cut to 1.5% in August given low underlying inflation and with the labour market losing momentum. We are surprised that increased uncertainty has not materially dented confidence, but there could be a delayed impact given job ads are down sharply in early July. We view S&P’s recent decision to lower Australia’s credit rating outlook to negative as a downside risk to growth," said ANZ in a report to clients.

The Aussie extended slump post minutes to hit the lowest since July 8 even though the RBA did not provide any explicit hint of August easing. AUD/USD extends slump, trades 1.27 pct lower on the day at around 0.7495 at 1100 GMT.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan