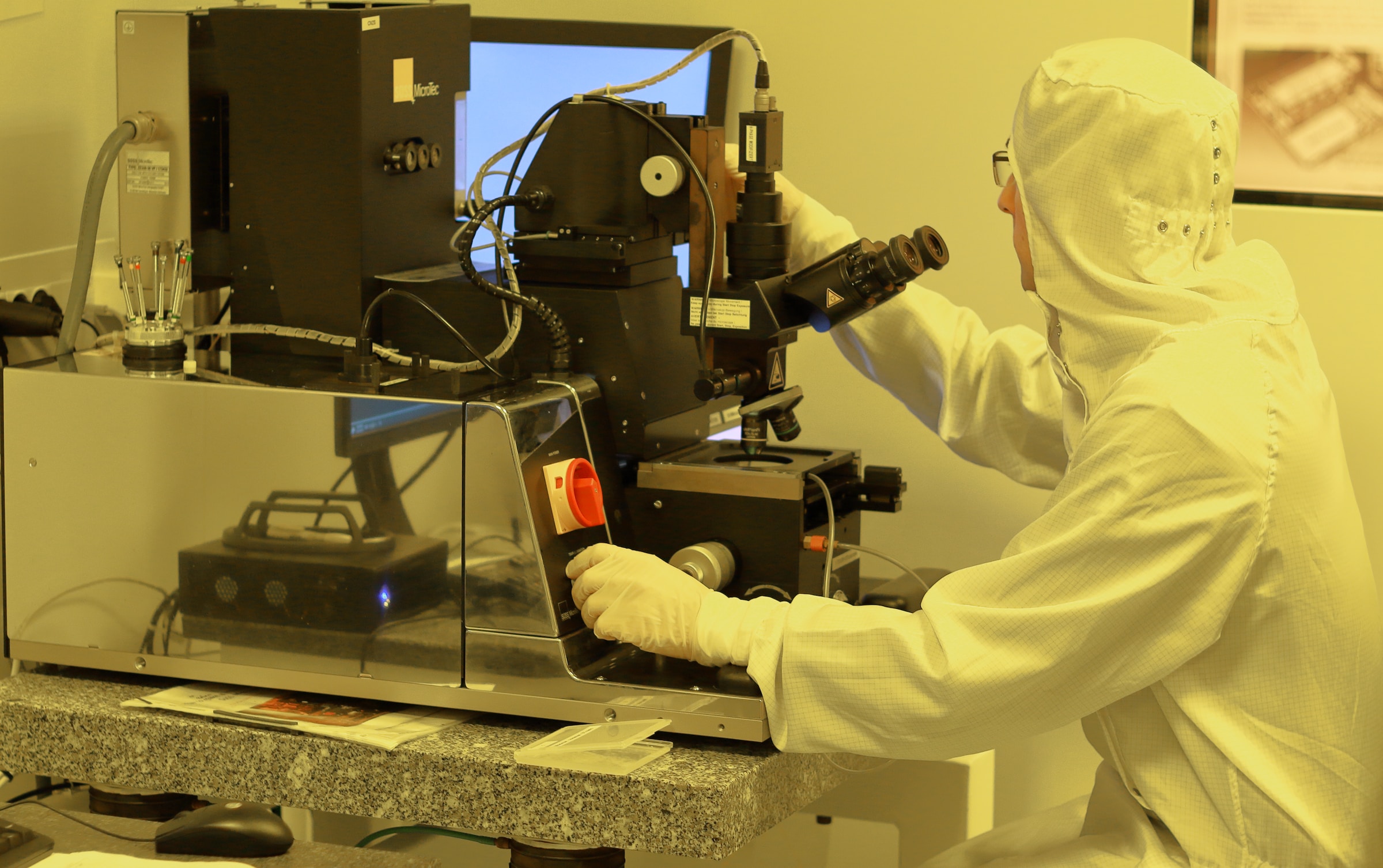

Mitsubishi Chemical Group announces a new semiconductor materials plant, operational by March 2025. While the location remains undecided, Fukuoka Prefecture is under consideration. Given the component's pivotal role in global electronics, this move aligns with Japan's strategy to boost its semiconductor sector.

Semiconductor chips, vital components in electronic devices such as phones and computers, gained global attention due to supply chain issues during the pandemic. Although semiconductor demand has experienced a slight dip in 2023 compared to the previous year, industry experts project a rebound in 2024.

Recognizing the criticality of semiconductors and the need for increased production, Mitsubishi Chemical's plan aligns with the Japanese government's investments in the domestic semiconductor sector. In 2021, the government announced its ambitious goal of exceeding ¥13 trillion ($87.6 billion) in annual semiconductor revenue by 2030.

This vision includes government-backed projects like Rapidus. The Rapidus project broke ground on a new facility in Hokkaido on September 1st.

Amid the government's renewed focus, local and foreign businesses are expanding semiconductor-related production in Japan. Taiwan Semiconductor Manufacturing Co., the world's largest contract chipmaker, is currently constructing a plant in Kumamoto Prefecture and has expressed interest in further expansion, contingent upon customer demand and government support.

Additionally, prominent companies such as Micron Technology and Intel have shown interest in entering the Japanese market. It resulted in substantial U.S., European, and South Korean investments.

The spotlight on semiconductors coincides with escalating tensions between the U.S. and China. The U.S. aims to restrict China's ability to establish a high-tech industry that could rival its own. As a result, the semiconductor industry has become an area of strategic importance and geopolitical competition.

As Mitsubishi Chemical progresses in its new semiconductor materials plant plan, the development can strengthen Japan's semiconductor sector and support its technological ambitions. This forthcoming facility, set to operate by 2025, underscores Mitsubishi Chemical's commitment to meeting future semiconductor demand while contributing to the growth of the global electronics industry.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January